Key Takeaways

-

Home prices and inventory: Florida’s median home price is $410,500, with a 33% increase in available homescompared to 2024.

-

Financial factors: Florida’s 2025 conforming loan limit is $806,500 (higher in Key West), and homeowners insurance averages $5,527 per year.

-

Assistance programs: First-time home buyers can receive up to $50,000 in aid through various state and city programs.

-

Securing the best mortgage: Buyers should focus on credit improvement, larger down payments, and comparing loan options to get the lowest rates.

Purchasing a home in Florida is exciting but requires careful planning. In 2023, first-time home buyers made up 20% of home purchases statewide. With Florida’s evolving real estate market, understanding current trends and loan programs is crucial for success in 2025.

Florida Real Estate Market Outlook for 2025

Florida’s housing market continues to grow, attracting younger and more diverse buyers. Increased inventory and shifting home prices create new opportunities for first-time buyers.

Home Prices and Inventory Trends

Median Home Price: As of January 2025, Florida’s median home price is $410,500

Housing Inventory: Available homes have increased 33% from January 2024, offering buyers more options.

Regional Market Highlights

South Florida: The Miami-Fort Lauderdale area expects a 24% jump in home sales and a 9% increase in prices.

Orlando Metro: This region, including Kissimmee and Sanford, forecasts a 15.2% rise in home sales and a 12.1% price increase.

Key Financial Considerations for Florida Homebuyers

Loan Limits

- The 2025 conforming loan limit for most of Florida is $806,500.

- In Monroe County (Key West), the limit rises to $967,150.

Homeowners Insurance Costs

- Florida’s homeowners insurance premiums average $5,527 per year due to risks like hurricanes and flooding.

- Flood insurance, often required, adds about $66 per month.

Property Taxes

- Florida has no state income tax, but property taxes average 0.91% of a home’s assessed value.

- The Save Our Homes exemption caps tax increases at 3% annually for current homeowners. First-time buyers may face higher initial rates.

First-Time Home buyer Assistance Programs in Florida

| Florida Hometown Heroes Program | Up to $35,000 in assistance for eligible community workers, structured as a non-forgivable, interest-free second mortgage. |

| Florida Assist | Offers $10,000 in deferred, zero-interest loans for down payments. Repayment is due when the primary mortgage is paid off. |

| Florida Homeownership Loan Program (FL HLP) | Provides $10,000 in down payment assistance, repayable over 15 years. |

City-Specific Assistance Programs

| Orlando | Offers up to $45,000 in forgivable loans. |

| Panama City | Provides up to $50,000 to cover closing costs, down payments, and mortgage payments through the Panama City Grant |

| Pensacola | Disperses up to $45,000 based upon your income for down payment and closing cost assistance through the SHIP First Time HomeBuyers Program |

| Tampa | Provides up to $40,000 in deferred loans through the Dare to Own the Dream program. |

How to Secure the Best Mortgage Rates

- Boost Credit Scores: Higher scores qualify for better interest rates.

- Increase Down Payments: Larger down payments lower monthly costs and remove private mortgage insurance (PMI).

- Reduce Debt: Lowering your debt-to-income ratio increases loan approval chances.

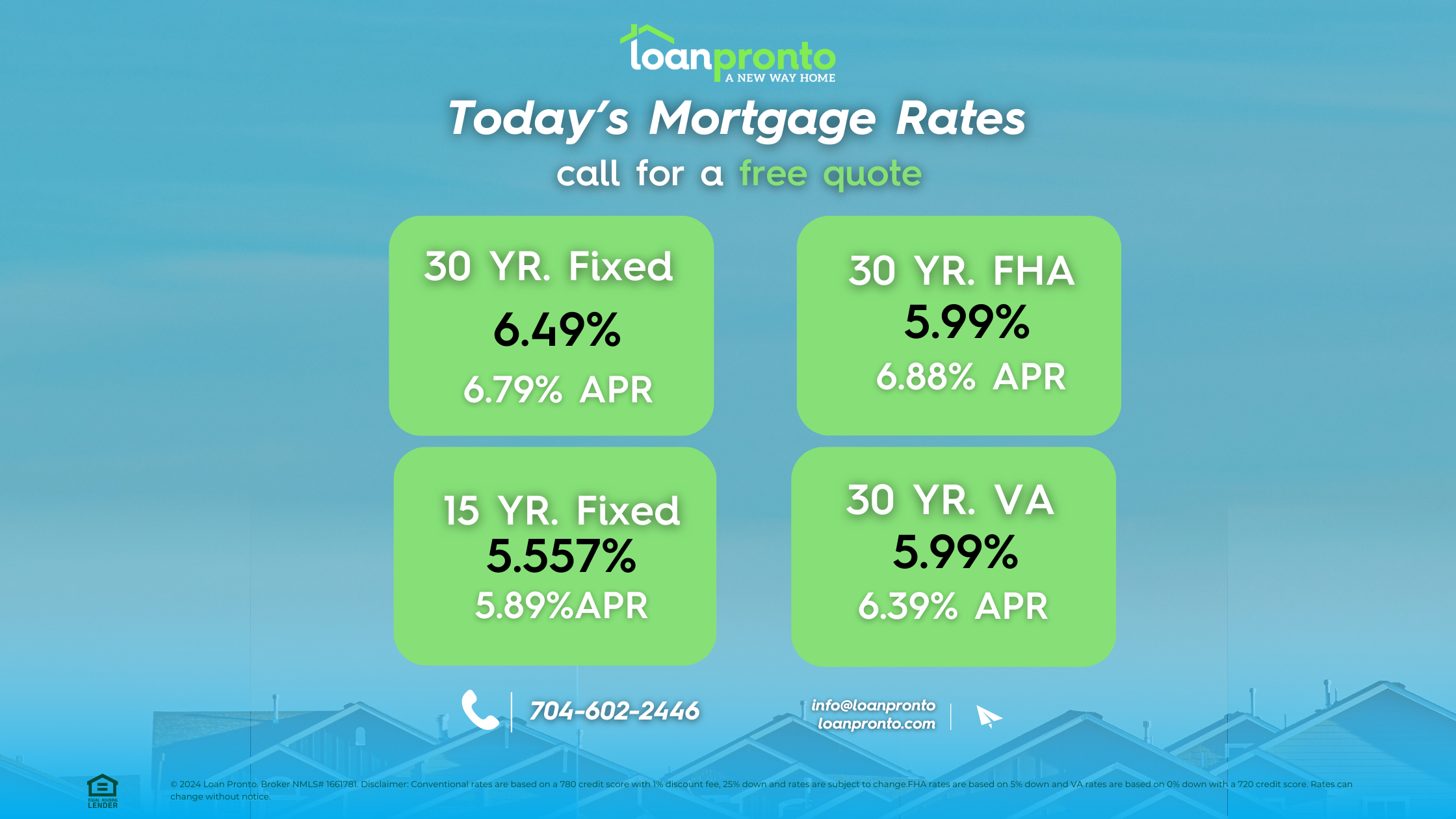

- Compare Loan Programs: FHA, VA, and USDA loans may offer lower rates and better terms than conventional mortgages.

Get Started Today!

Buying a home in Florida requires research, financial planning, and an understanding of available assistance programs. By staying informed about the market and preparing financially, first-time home buyers can navigate the process with confidence and secure the best possible deal.

If you’re ready to explore your homebuying options, contact us today to discuss loan programs that fit your needs.

FAQs: Buying a Home in Florida

No SSN required. Zero impact to credit. Your Information is never sold.