Mortgage Rates Drop in Early 2025: What It Means for Homebuyers and Homeowners

The 2025 mortgage market is starting off with encouraging news: mortgage rates have dropped after weeks of stability and a slight uptick last week. This decline opens doors for homebuyers and homeowners looking to save money and secure better financial options. Here’s a closer look at why rates have dropped, what it means for you, and how to take advantage of this opportunity.

Why Mortgage Rates Are DROPPING

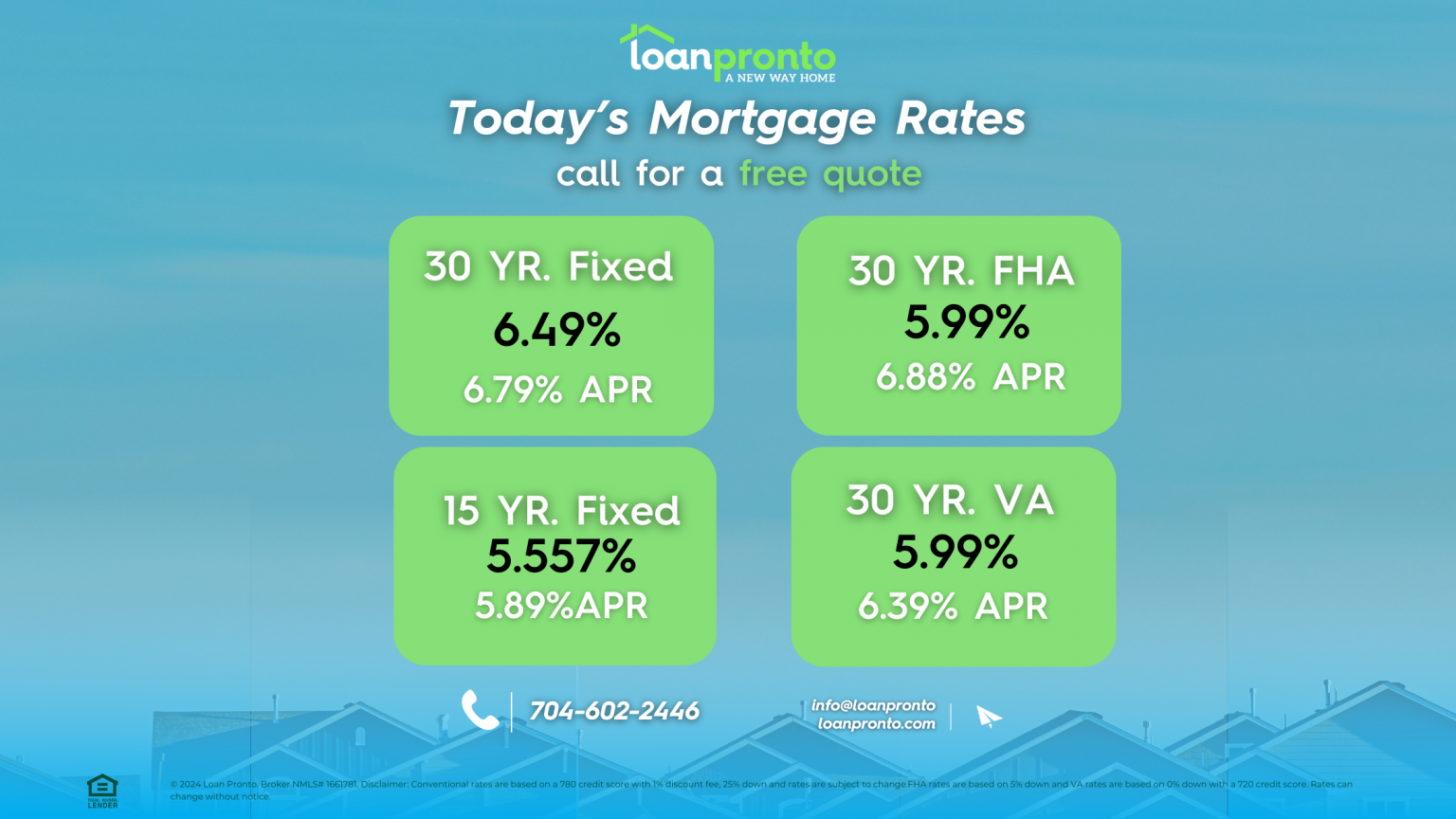

| Product | Rate | Last Week | Change |

| 30-year fixed | 6.49% | 6.643% | ↓ 0.153 |

| 15-year fixed | 5.557% | 5.613% | ↓ 0.056 |

| 30-year FHA | 5.99% | 6.124% | ↓ 0.134 |

| 30-year VA | 5.99% | 6.124% | ↓ 0.134 |

A combination of economic and seasonal factors contributed to this week’s drop in mortgage rates. Understanding these trends can help you plan your next move in the market:

Improved Inflation Data:Recent inflation reports show a slowdown, reducing pressure on interest rates. With inflation stabilizing, mortgage rates have become more favorable for borrowers.

Treasury Yield Declines: As investors move toward safer assets like bonds, Treasury yields have dropped by 4 basis points bringing them to 4.53%, directly impacting mortgage rates. Lower yields mean reduced borrowing costs for homebuyers.

Seasonal Adjustments: Early-year market adjustments often bring temporary rate declines. This seasonal trend is a golden opportunity to lock in lower rates before the market adjusts again.

How Lower Mortgage Rates Benefit You

Whether you’re in the market to buy a new home or considering refinancing your current loan, this week’s rate drop provides valuable opportunities.

For Homebuyers

Now is an excellent time to purchase a home. Lower rates can:

- Increase Buying Power: Stretch your budget to afford a larger home or secure a property in a better neighborhood.

- Lower Monthly Payments: Reduced interest rates mean significant long-term savings.

- Lock in Stability: Secure a low rate today before the market shifts upward.

For Homeowners

If you already own a home, refinancing at a lower rate can deliver substantial financial benefits:

- Cut Monthly Costs: Lower your payments and save hundreds annually.

- Consolidate Debt: Use cash-out refinancing to pay off high-interest obligations.

- Build Equity Faster: Switch to a shorter loan term and save on interest over time.

Market Outlook: What’s Next?

Mortgage rates remain dynamic, and staying informed is crucial. Here’s what to watch for in the coming weeks:

- Inflation Data: Upcoming reports will shape the outlook for interest rate stability.

- Treasury Market Trends: Changes in investor behavior may influence mortgage costs further.

- Housing Market Activity: Reports on home sales, starts, and pending transactions could affect market trends.

Current Mortgage Rates

This week’s dip in mortgage rates offers a moment of opportunity for both buyers and homeowners. While rates show stability and remain historically favorable, staying informed and proactive is key to maximizing these market shifts. If you’re considering buying, refinancing, or advising clients, now is the time to act. Take advantage of the current conditions and stay tuned for more updates as we continue navigating the 2025 mortgage market together.

| Product | Rate | Last Week | Change |

| 30-year fixed | 6.49% | 6.643% | ↓ 0.153 |

| 15-year fixed | 5.557% | 5.613% | ↓ 0.056 |

| 30-year FHA | 5.99% | 6.124% | ↓ 0.134 |

| 30-year VA | 5.99% | 6.124% | ↓ 0.134 |

DISCLAIMER:

ALL LOANS ARE SUBJECT TO CREDIT APPROVAL. INTEREST RATES ARE SUBJECT TO CHANGE DAILY AND WITHOUT NOTICE. CURRENT INTEREST RATES SHOWN ARE INDICATIVE OF MARKET CONDITIONS AND INDIVIDUAL QUALIFICATIONS AND WILL VARY UPON YOUR LOCK-IN PERIOD, LOAN TYPE, CREDIT SCORE, LOAN TO VALUE, PURPOSE, AND LENDING SOURCE.

DISCLAIMER: FOR NEW JERSEY PURPOSES, WE ARE NOT A LENDER AND CANNOT GUARANTEE THESE INTEREST RATES.

Now at 6.49%, down 15.3 basis points from last week. This option is popular for its lower monthly payments despite higher interest over the loan term.

15-year fixed-rate mortgages

Currently at 5.557%, down 5.6 basis points. While payments are higher, this loan helps borrowers pay off their mortgage faster and save on total interest.

Tools and Resources

Use our free mortgage and amortization calculators to explore your monthly payments, including taxes, insurance, and interest. Take control of your financial future and maximize your savings.

No SSN required. Zero impact to credit. Your Information is never sold.