Key Takeaways

-

Locking your mortgage rate secures your interest rate and ensures predictable payments, even if market rates increase.

-

Floating your rate can save you money if rates drop, but it’s risky and market fluctuations are unpredictable.

-

Longer rate locks (90-120 days) often come with fees, so timing is key to avoid additional costs.

-

Some lenders offer float-down options, allowing you to adjust your locked rate if market conditions improve, though these options may come with a fee.

One of the most critical decisions when securing a mortgage is whether to lock in your interest rate or let it float in hopes of securing a better deal. Mortgage rates fluctuate daily—sometimes multiple times a day—so this choice can significantly impact your monthly payment and the total cost of your loan. Understanding how rate locks work, the risks of floating, and when to act will help you make the best financial decision.

WHAT IS A MORTGAGE RATE LOCK?

A rate lock is an agreement between you and your lender to secure a specific interest rate for a set period—typically 30 to 60 days, though some lenders offer locks up to 120 days. Locking your rate protects you from rising rates while you finalize your home purchase or refinance.

Why Lock Your Rate?

- Protection Against Market Fluctuations – If rates rise before you close, your locked-in rate remains unchanged.

- Predictable Mortgage Payments – Your interest rate and monthly payment stay the same.

- Peace of Mind – No stress over unexpected rate hikes affecting your loan approval or affordability.

When Can You Lock Your Rate?

Lenders set different rules for when you can lock in your rate. Some allow locking as soon as you’re pre-approved, while others require an accepted offer on a home. Locking too early could cause your lock period to expire before closing, which may lead to extension fees or a higher rate if you need to relock.

What Does It Mean to Float Your Interest Rate?

Floating your mortgage rate means choosing not to lock in a rate, hoping for a drop before closing. This strategy can be beneficial if rates are trending downward but carries significant risks.

Why Float Your Rate?

- Potential for a Lower Interest Rate – If rates decrease, your monthly payment could be lower.

- Flexibility for Longer Closing Timelines – If your closing extends beyond the standard lock period (e.g., 60+ days), floating can help avoid rate lock extension fees.

Risks of Floating YOUR INTEREST RATE

- Rates Could Increase – If rates rise instead of fall, you could pay thousands more over the life of your loan.

- Uncertainty and Stress – Market fluctuations are unpredictable, making floating a riskier option.

How Are Mortgage Rates Determined?

Several factors influence mortgage rates:

- Economic Conditions – Strong economic growth can push rates higher, while downturns often lead to lower rates.

- Federal Reserve Actions – While the Fed doesn’t directly set mortgage rates, its policies influence the overall interest rate environment.

- Mortgage Demand – High loan demand can push rates up, while lower demand may lead to rate drops.

- Treasury Bond Yields – Mortgage rates often move in line with 10-year Treasury bond yields.

How Long Can a Rate Lock Last?

Most lenders offer rate locks of 30, 45, or 60 days. Longer locks (90-120 days) are available for a fee. If you need more time to close, extensions are possible, though they typically cost a percentage of your loan amount.

Cost of a Mortgage Rate Lock

- Standard rate locks (30-60 days) usually have no fee.

- Extended rate locks may cost 0.25% to 0.5% of the loan amount.

- Lock extensions also come with fees, making proper timing essential.

What Happens If Rates Drop After You Lock?

Many borrowers worry about locking too soon and missing out on a lower rate. Some lenders offer options to adjust your rate after locking, but these usually come with costs.

Float-Down Options

Some lenders allow rate adjustments if market conditions improve after you lock. However, float-down options often involve fees, so weigh the cost against potential long-term savings.

Discount Points

Another way to secure a lower rate is by purchasing discount points. Each point typically costs 1% of the loan amountand can reduce your interest rate by 0.25%. If you plan to stay in your home long-term, buying points could save you money over time.

Should You Lock or Float?

Deciding what option is better for you depends on your risk tolerance and market conditions.

Lock Your Rate If:

- Rates are rising or expected to increase.

You want certainty in your mortgage payment.

You’re risk-averse and don’t want to gamble on rate fluctuations.

Float Your Rate If:

- Rates are trending downward and you’re comfortable with risk.

You have a long closing timeline (60+ days) on your home and don’t want to pay an extended fee.

You have a float-down option available and want to see if rates improve.

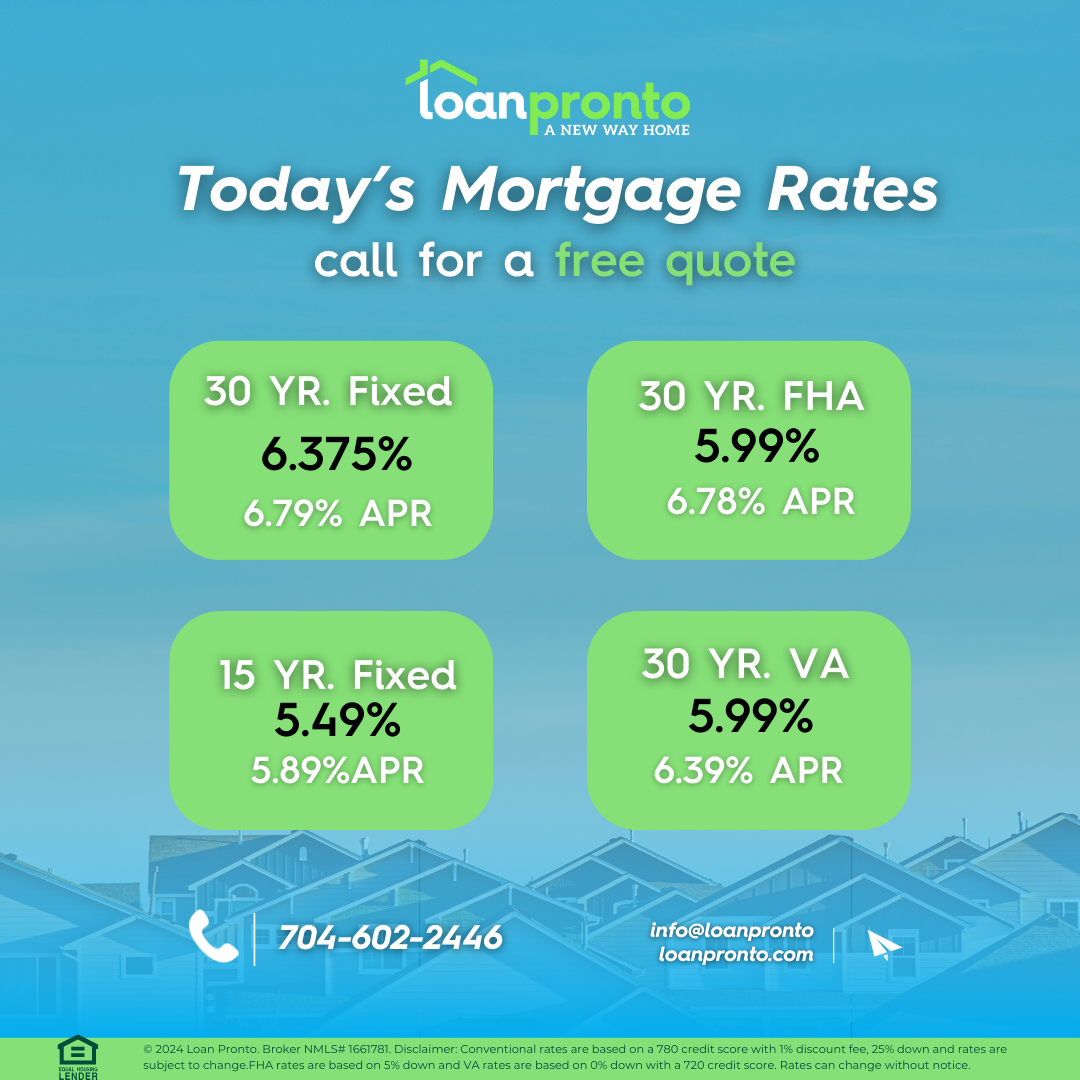

GET YOUR FREE RATE QUOTE TODAY

Locking or floating your mortgage rate is a crucial decision that can impact your financial future. If you want stability and protection against rising rates, locking in now may be the best move. If you’re comfortable with some risk and believe rates will drop, floating could save you money.

Not sure what’s right for you? Don’t leave it to chance! Reach out today for a personalized rate quote.

FAQ: Mortgage Rate Locks

No SSN required. Zero impact to credit. Your Information is never sold.