This week, mortgage rates saw a slight dip compared to last week, but overall, they remain relatively steady. This was due to several economic indicators, market trends and a recent Federal Reserve meeting. While we didn’t experience any major shifts, this small dip could be good news for buyers and homeowners considering a refinance.

What’s Driving Mortgage Rates?

Mortgage rates are influenced by a variety of economic factors, including inflation reports, Federal Reserve policies, and investor activity in the bond market. Recently, economic data has pointed to stable inflation, which has helped keep rates from rising further.

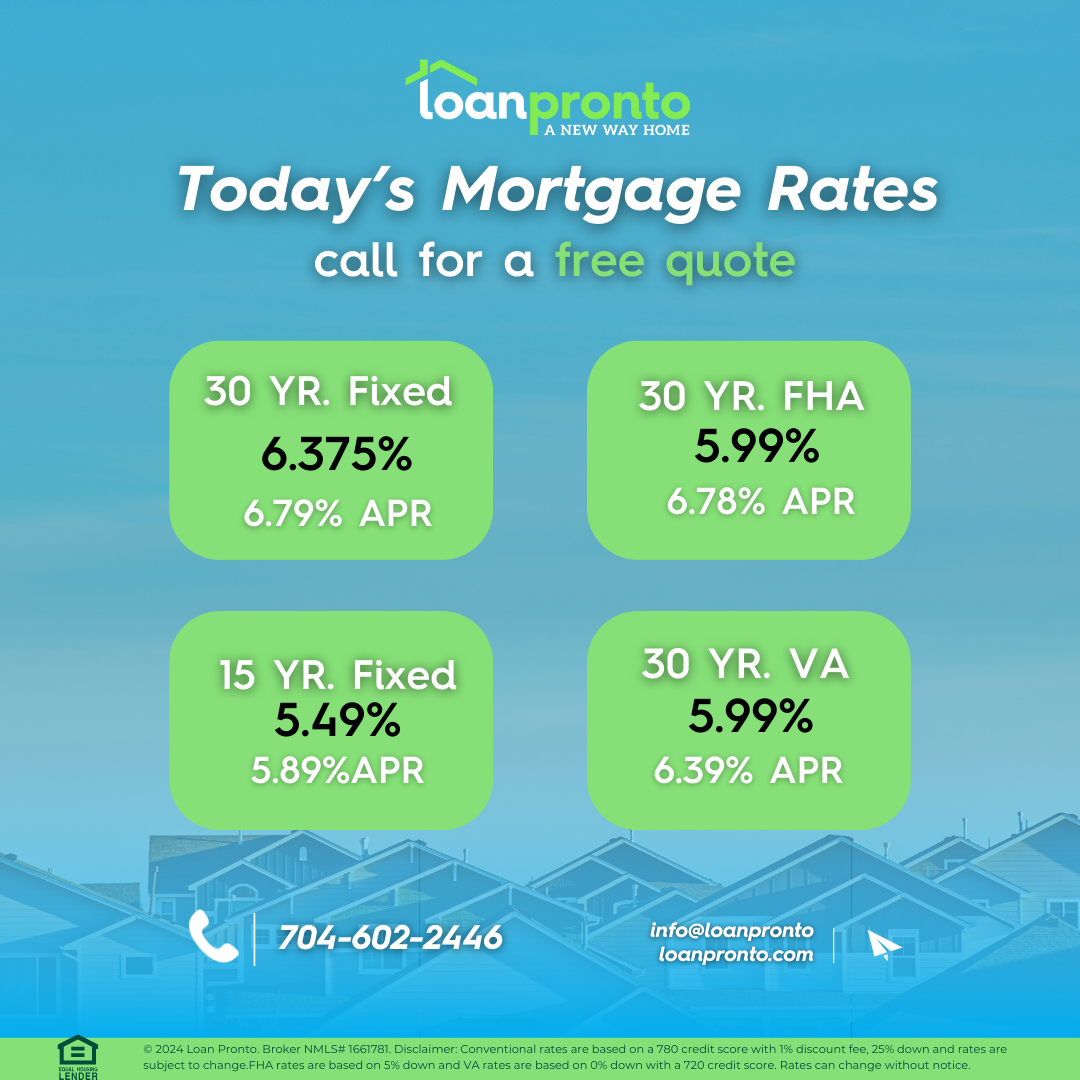

| Product | Rate | Last Week | Change |

| 30-year fixed | 6.375% | 6.49% | ↓ 0.115 |

| 15-year fixed | 5.49% | 5.557% | ↓ 0.067 |

| 30-year FHA | 5.99% | 5.99% | +/- 0.0 |

| 30-year VA | 5.99% | 5.99% | +/- 0.0 |

What to Expect Next Week

Looking ahead, key economic reports and Federal Reserve commentary could influence where mortgage rates go from here. If inflation data continues to show signs of cooling, we could see further rate improvements. However, any unexpected economic shifts could cause volatility.

What This Means for Homebuyers and Homeowners

- Homebuyers: With rates holding steady, now could be a good time to lock in a rate before any potential increases.

- Homeowners: If you’ve been waiting for a lower rate to refinance, keep an eye on next week’s trends.

While mortgage rates dipped slightly this week, they remain in a stable range. As always, staying informed about market trends can help you make the best financial decisions. Check back next week for the latest mortgage rate update!

Would you like a specific call-to-action added, like contacting your team for rate info?

| Product | Rate | Last Week | Change |

| 30-year fixed | 6.375% | 6.49% | ↓ 0.115 |

| 15-year fixed | 5.49% | 5.557% | ↓ 0.067 |

| 30-year FHA | 5.99% | 5.99% | +/- 0.0 |

| 30-year VA | 5.99% | 5.99% | +/- 0.0 |

DISCLAIMER: ALL LOANS ARE SUBJECT TO CREDIT APPROVAL. INTEREST RATES ARE SUBJECT TO CHANGE DAILY AND WITHOUT NOTICE. CURRENT INTEREST RATES SHOWN ARE INDICATIVE OF MARKET CONDITIONS AND INDIVIDUAL QUALIFICATIONS AND WILL VARY UPON YOUR LOCK-IN PERIOD, LOAN TYPE, CREDIT SCORE, LOAN TO VALUE, PURPOSE, AND LENDING SOURCE. DISCLAIMER: FOR NEW JERSEY PURPOSES, WE ARE NOT A LENDER AND CANNOT GUARANTEE THESE INTEREST RATES.

Now at 6.375%, down 11.5 basis points from last week. This option is popular for its lower monthly payments despite higher interest over the loan term.

15-year fixed-rate mortgages

Currently at 5.49%, down 6.7 basis points. While payments are higher, this loan helps borrowers pay off their mortgage faster and save on total interest.

Tools and Resources Use our free mortgage and amortization calculators to explore your monthly payments, including taxes, insurance, and interest. Take control of your financial future and maximize your savings.

No SSN required. Zero impact to credit. Your Information is never sold.