Key Takeaways

-

Contact your mortgage servicer immediately after a disaster to explore relief options like forbearance or loan modifications.

-

Homeowners insurance payouts can help cover mortgage payments, but coverage limitations may apply.

-

Property tax relief programs can lower your tax bill if your home is significantly damaged.

-

Preparing for future disasters by reviewing insurance, building an emergency fund, and knowing relief programs can ease financial recovery.

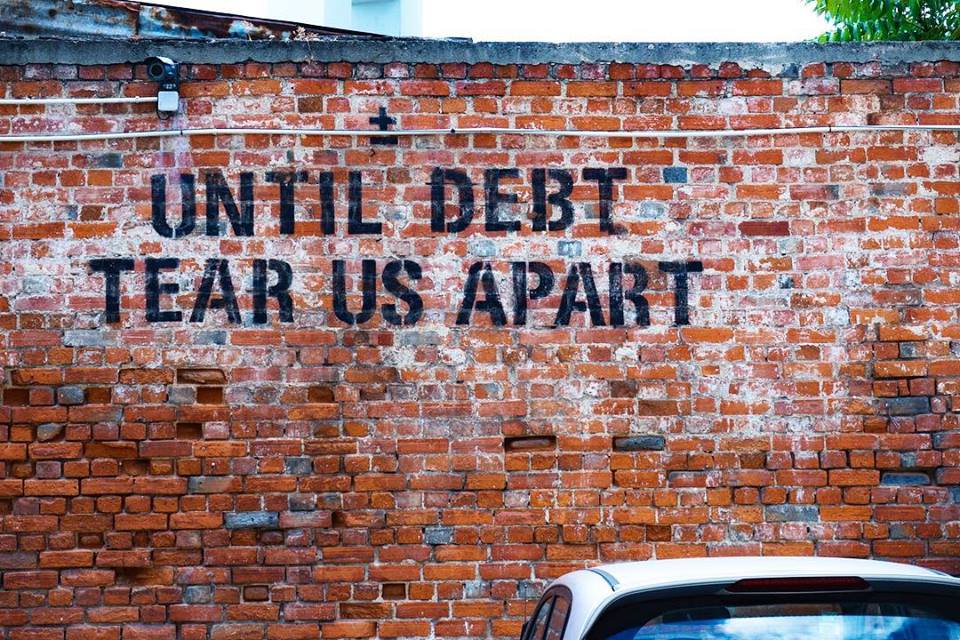

Mortgage relief after natural disaster

Natural disasters like hurricanes, wildfires, tornadoes, and floods can destroy homes and communities. Even if your home is severely damaged or destroyed, you still have to pay your mortgage. After ensuring your family’s safety, take these steps to get mortgage relief and explore property tax relief options to help ease the financial strain during recovery.

How to Handle Your Mortgage After a Natural Disaster

Your mortgage doesn’t disappear when your home is damaged or destroyed. If you still owe on your loan, you’re responsible for making payments even in the aftermath of a disaster. Here’s how to manage your mortgage:

Contact Your Mortgage Servicer: Reach out to your lender immediately to discuss disaster relief options. Many servicers offer mortgage forbearance programs, allowing you to temporarily pause or reduce payments. Remember, deferred payments must be repaid later, so plan accordingly.

Review Your Insurance Coverage:Check your homeowners insurance policy to understand what’s covered. Insurance payouts can help you continue making payments while rebuilding or relocating. Ensure you know how much compensation you’ll receive and any limitations on coverage.

Explore Loan Modifications:Ask your lender about loan modification options to make payments more manageable. Modifications might include lowering your interest rate or extending your loan term to reduce monthly payments.

Managing Property Taxes After a Natural Disaster

If your home is damaged, its assessed value—and your property tax bill—may change. However, taxes on the land itself remain. Follow these steps to adjust your property taxes:

Apply for Property Tax Relief: Many states offer programs like Disaster Property Tax Relief or Misfortune and Calamity Tax Relief to lower your tax assessment based on the extent of damage. Contact your local tax assessor’s office to check your eligibility and begin the application process.

Document the Damage: Provide clear evidence of your home’s condition, including photos, repair estimates, and insurance claims. These records are essential for property tax reassessment and relief applications.

Should You Rebuild or Relocate After a Natural Disaster?

Deciding whether to rebuild or relocate is a major choice influenced by insurance payouts, rebuilding costs, and future risks. Consider the following:

- Insurance Payouts: Ensure your insurance payout covers the full cost of rebuilding. If there’s a shortfall, you may need to use savings or explore additional loan options.

- Local Building Codes: Check local regulations before rebuilding. Post-disaster building codes may increase construction costs, so factor these into your budget.

- Future Disaster Risks: Consider the likelihood of future disasters in the area. If risks are high, relocating might be a safer long-term decision

How to Prepare for Future Natural Disasters

While recovery is challenging, taking these steps can help protect you from future disasters:

Review Your Insurance Policy: Ensure you have adequate coverage, including flood, earthquake, or hurricane insurance.

- Build an Emergency Fund: Set aside funds to cover immediate expenses if disaster strikes again.

- Learn About Relief Programs: Familiarize yourself with federal, state, and local assistance options like FEMA disaster relief programs.

Taking Control of Your Recovery

Recovering from a natural disaster requires navigating emotional, financial, and logistical hurdles. By working with your mortgage servicer, insurance provider, and local tax office, you can maximize relief options and rebuild your financial stability. Facing a disaster is never easy, but with the right steps, you can create a clear path toward recovery and future security.

Take Action Now

Contact us today to explore disaster relief programs, refinancing options, or loan modifications tailored to your situation.

FAQ: Mortgage Relief After a Natural Disaster

No SSN required. Zero impact to credit. Your Information is never sold.