This week, mortgage rates held steady, remaining unchanged compared to last week. This stability comes after a period of fluctuation and a recent notable decrease in rates the week prior. For those watching the mortgage market closely—whether as potential homebuyers, realtors, or industry professionals—this consistency is a welcome sign. Periods of steady mortgage rates often reflect a market that is balancing itself after responding to various economic pressures and the Federal Reserve. Let’s dive deeper into what’s keeping rates stable, what this means for buyers and realtors, when to lock a rate, and what we can expect as we look toward next week.

Why Are Mortgage Rates Holding Steady?

Mortgage rates are influenced by a variety of factors, including economic data, Federal Reserve policy, and investor sentiment. This week’s steadiness is likely the result of a balanced mix of recent reports on employment, inflation, and consumer spending, none of which have caused significant market movement. Key factors contributing to the current rate environment include:

- Economic Data: Recent reports on inflation and job growth have shown modest progress, keeping major rate fluctuations in check.

- Federal Reserve Influence: The Fed has indicated a measured approach to adjusting monetary policy, signaling that further rate hikes may be paused unless inflation data worsens. More will be known upon their next meeting this upcoming week.

- Market Sentiment: Investors appear cautiously optimistic, leading to a level of calm in the bond markets, which directly affect mortgage rates.

This combination has allowed mortgage rates to stabilize, providing some predictability for homebuyers and real estate professionals.

What Does Steady Mortgage Rates Mean for Buyers and Realtors?

For potential homebuyers, steady rates are a golden opportunity. They offer a chance to plan financing with confidence, knowing that the numbers are unlikely to shift significantly in the short term. If you’ve been waiting to lock in a rate, now is a good time to act. For realtors, this stability creates an environment where clients can make informed decisions without the urgency of rapid rate increases. Realtors can leverage this period to highlight the long-term benefits of homeownership and the cost-saving advantages of securing financing while rates remain favorable.

Should Buyers Lock in Rates Now?

While rates are currently stable, the mortgage market can shift quickly in response to economic news or policy changes. Locking in a rate now could be a wise choice for those who are ready to move forward with a home purchase or refinance. For buyers who are still in the planning stages, this is a good time to explore pre-approval options and consult with lenders.

What’s Next for Mortgage Rates?

As we look ahead to next week, a few key developments could impact mortgage rates:

- Inflation Reports: Updated inflation data will provide insights into whether prices are continuing to cool, a factor that heavily influences rate trends.

- Federal Reserve Signals: Any new comments or updates from the Federal Reserve could provide hints about future rate policies.

- Economic Indicators: Additional, recent, data on consumer spending, wage growth, or the housing market could sway investor sentiment and, in turn, mortgage rates.

While this week’s stability is encouraging, it’s important to remain vigilant. Even small adjustments in the economic landscape can lead to rate changes, making it essential to monitor the market closely.

This week’s recent steady mortgage rates are a reassuring sign for buyers and realtors. Stability provides a chance to plan, lock in favorable rates, and make informed decisions. However, with economic reports and Federal Reserve signals on the horizon, staying informed will be key to navigating the weeks ahead. Whether you’re a first-time buyer, a seasoned investor, or a realtor guiding clients, the current mortgage rate environment offers opportunities to take advantage of favorable conditions. Stay proactive, monitor the market, and be prepared to seize the moment as it arises.

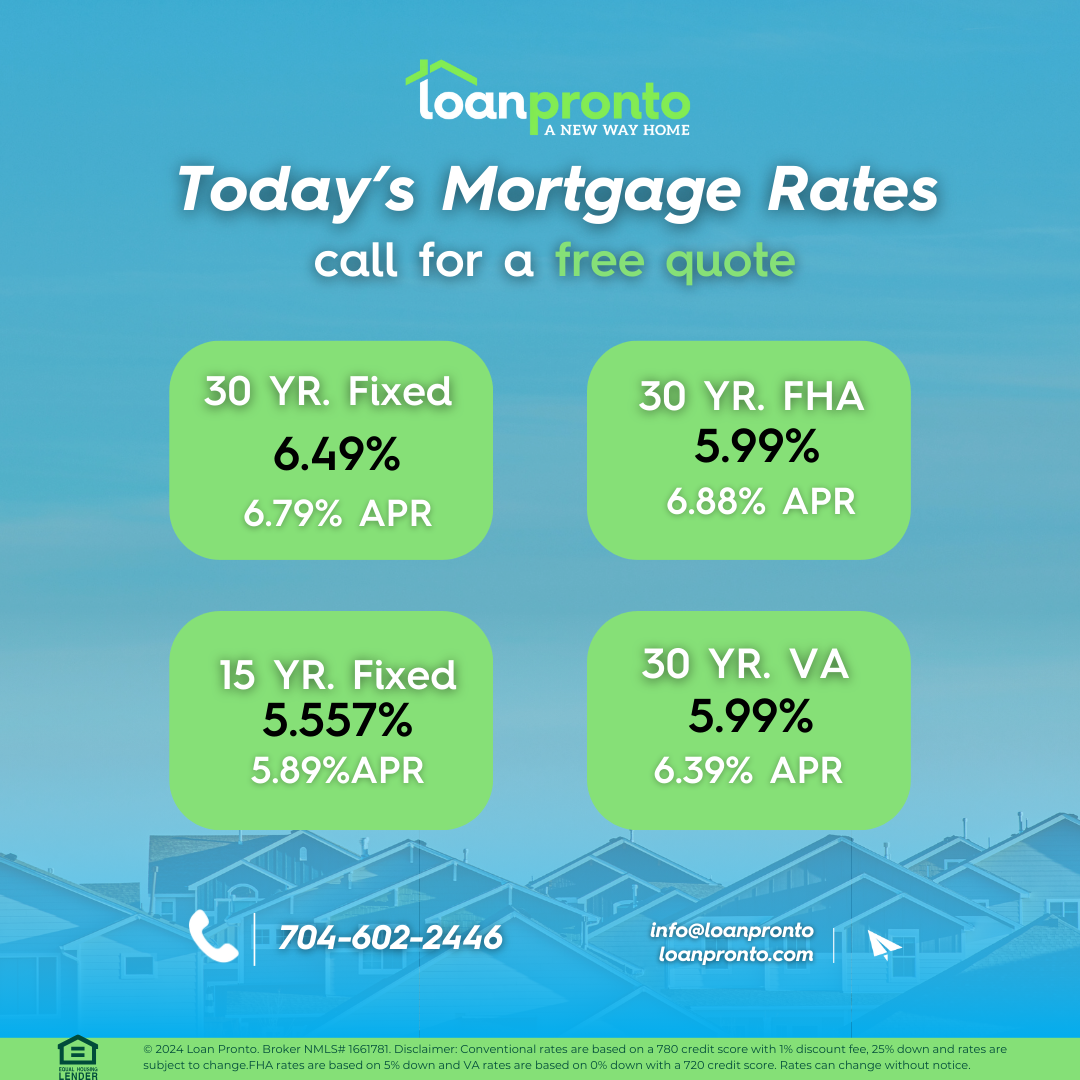

| Product | Rate | Last Week | Change |

| 30-year fixed | 6.49% | 6.49% | +/- 0.0 |

| 15-year fixed | 5.557% | 5.557% | +/- 0.0 |

| 30-year FHA | 5.99% | 5.99% | +/- 0.0 |

| 30-year VA | 5.99% | 5.99% | +/- 0.0 |

DISCLAIMER:

ALL LOANS ARE SUBJECT TO CREDIT APPROVAL. INTEREST RATES ARE SUBJECT TO CHANGE DAILY AND WITHOUT NOTICE. CURRENT INTEREST RATES SHOWN ARE INDICATIVE OF MARKET CONDITIONS AND INDIVIDUAL QUALIFICATIONS AND WILL VARY UPON YOUR LOCK-IN PERIOD, LOAN TYPE, CREDIT SCORE, LOAN TO VALUE, PURPOSE, AND LENDING SOURCE.

DISCLAIMER: FOR NEW JERSEY PURPOSES, WE ARE NOT A LENDER AND CANNOT GUARANTEE THESE INTEREST RATES.

Now at 6.49%, down 0.0 basis points from last week. This option is popular for its lower monthly payments despite higher interest over the loan term.

15-year fixed-rate mortgages

Currently at 5.557%, down 0.0 basis points. While payments are higher, this loan helps borrowers pay off their mortgage faster and save on total interest.

Tools and Resources

Use our free mortgage and amortization calculators to explore your monthly payments, including taxes, insurance, and interest. Take control of your financial future and maximize your savings.

No SSN required. Zero impact to credit. Your Information is never sold.