Mortgage rates held steady this week, with only a slight decrease compared to last week. While many homebuyers and refinancers were hoping for more movement, the market remains in a wait-and-see mode, closely tracking economic data and key signals from the Federal Reserve.

So, what’s next for mortgage rates? Several key factors in the coming weeks could influence their direction.

What’s Keeping Mortgage Rates Stable?

The recent stability in mortgage rates is largely due to mixed economic data and cautious optimism in the market. Lenders are keeping a close eye on inflation trends, job reports, and the Fed’s stance on future rate cuts. While some experts anticipate lower rates in the coming months, others warn that persistent inflation or strong economic growth could keep rates elevated.

Key Factors That Could Move Mortgage Rates

Several upcoming reports and events could shift mortgage rates in the near future:

Inflation Data

The next Consumer Price Index (CPI) report will be a major indicator for mortgage rates. If inflation comes in lower than expected, it could push rates down as investors anticipate a softer stance from the Federal Reserve. On the other hand, higher inflation could lead to stubbornly high mortgage rates.

Federal Reserve Meeting Signals

The Fed’s interest rate decisions don’t directly set mortgage rates, but they influence investor sentiment. Any new comments from the Federal Open Market Committee (FOMC) could drive mortgage rate fluctuations. If the Fed signals future rate cuts, mortgage rates may trend lower.

Job Market Updates

A cooling job market can lead to lower mortgage rates. If upcoming employment reports show slowing job growth or rising unemployment, the Fed may feel more pressure to ease monetary policy, which could bring mortgage rates down.

What This Means for Homebuyers and Refinancers

While mortgage rates remain relatively steady, they are still significantly higher than the historic lows seen in recent years. This means:

Homebuyers should stay informed – Timing your rate lock could save you thousands over the life of your loan.

Refinancers should evaluate their options – If rates drop, refinancing could become a smart move to lower monthly payments.

Sellers should be aware of buyer affordability – Higher rates impact how much buyers can afford, potentially affecting home prices and demand.

Should You Lock in Your Mortgage Rate Now?

If you’re in the market for a home loan, deciding when to lock your rate is crucial. Here are some key considerations:

- If rates seem to be trending lower, you may want to wait for a better opportunity.

- If economic data suggests higher inflation or strong job growth, locking in sooner rather than later could be a smart move.

Stay Tuned for Next Week’s Mortgage Rate Update!

We’ll break down the latest rate trends and what they mean for homebuyers, homeowners, and the housing market. Don’t miss out on insights that could help you make the best financial decision for your future!

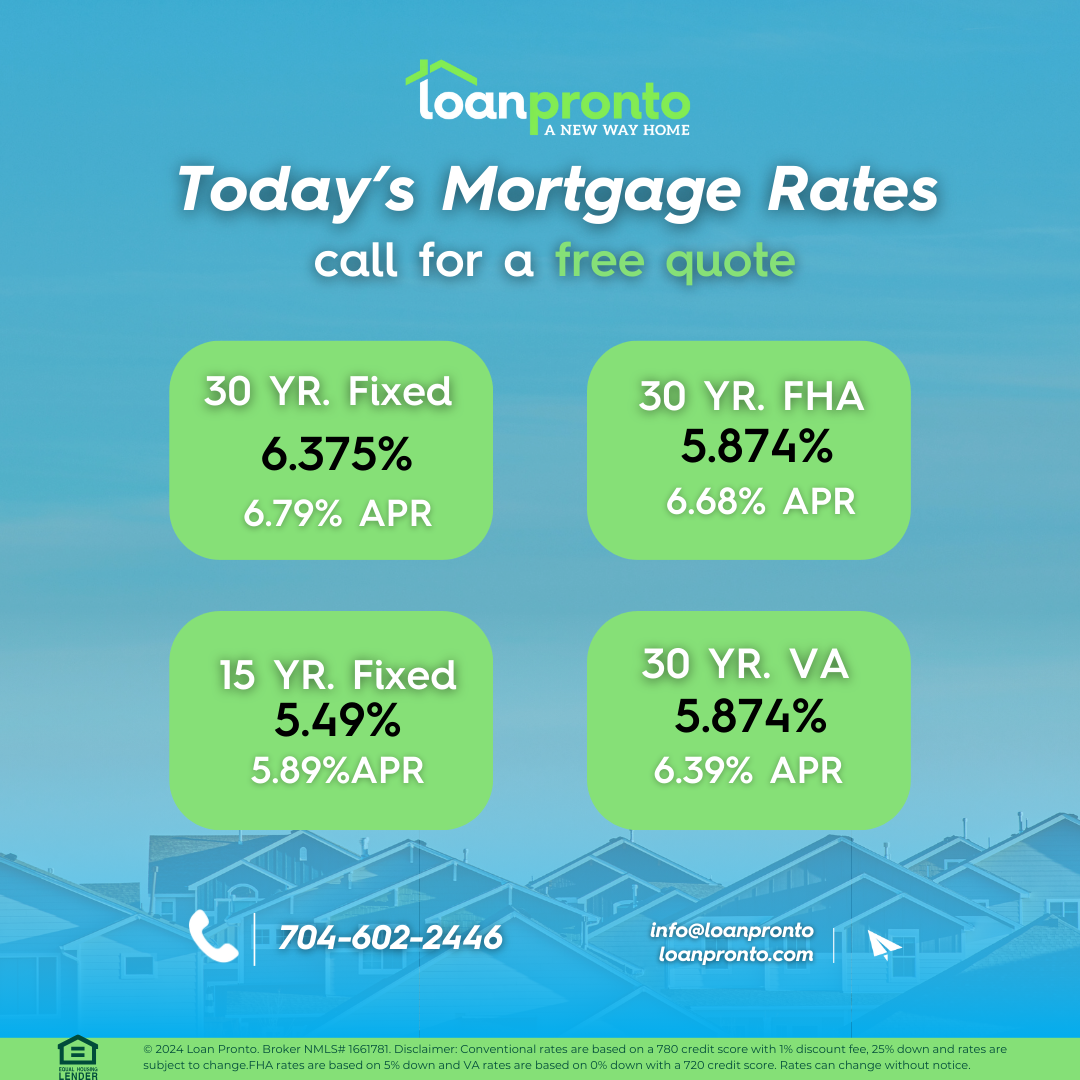

| Product | Rate | Last Week | Change |

| 30-year fixed | 6.375% | 6.375% | +/- 0.0 |

| 15-year fixed | 5.49% | 5.49% | +/- 0.0 |

| 30-year FHA | 5.874% | 5.99% | ↓ 0.116 |

| 30-year VA | 5.874% | 5.99% | ↓ 0.116 |

DISCLAIMER: ALL LOANS ARE SUBJECT TO CREDIT APPROVAL. INTEREST RATES ARE SUBJECT TO CHANGE DAILY AND WITHOUT NOTICE. CURRENT INTEREST RATES SHOWN ARE INDICATIVE OF MARKET CONDITIONS AND INDIVIDUAL QUALIFICATIONS AND WILL VARY UPON YOUR LOCK-IN PERIOD, LOAN TYPE, CREDIT SCORE, LOAN TO VALUE, PURPOSE, AND LENDING SOURCE. DISCLAIMER: FOR NEW JERSEY PURPOSES, WE ARE NOT A LENDER AND CANNOT GUARANTEE THESE INTEREST RATES.

Now at 6.375%, down 0.0 basis points from last week. This option is popular for its lower monthly payments despite higher interest over the loan term.

15-year fixed-rate mortgages

Currently at 5.49%, down 0.0 basis points. While payments are higher, this loan helps borrowers pay off their mortgage faster and save on total interest.

Tools and Resources Use our free mortgage and amortization calculators to explore your monthly payments, including taxes, insurance, and interest. Take control of your financial future and maximize your savings.

No SSN required. Zero impact to credit. Your Information is never sold.