Mortgage rates saw a slight but welcome drop in the market this week, continuing a solid trend for homebuyers and refinancers. This decrease was fueled by rate-friendly economic data, including today’s weak S&P Global Services PMI, which signaled slower economic growth. When economic data points to a cooling economy, mortgage rates often respond favorably—exactly what we saw this week.

What’s Driving Mortgage Rates?

Several factors helped keep mortgage rates in check:

Weak S&P Global Services PMI – This report showed a slowdown in the services sector, easing inflation concerns.

Steady Economic Data – Other reports this week didn’t spark inflation fears, allowing rates to remain stable.

Fed Policy Outlook – The Federal Reserve remains data-driven, and this type of economic softness could keep future rate hikes off the table.

What to Watch Next Week

Looking ahead, mortgage rates will depend on key economic reports, including:

Jobless Claims & Labor Data – If unemployment rises, rates could dip further.

Inflation Reports – Any signs of cooling inflation will support lower mortgage rates.

Federal Reserve Commentary – Markets will closely watch Fed officials for hints about future rate policy.

What This Means for Buyers & Sellers

For homebuyers: Slightly lower mortgage rates improve affordability and keep homeownership within reach.

For sellers: A stable rate environment supports buyer confidence, which helps keep the market moving.

This week was another step in the right direction for mortgage rates. If next week’s data continues to favor lower inflation, we could see more stability—or even another slight drop.

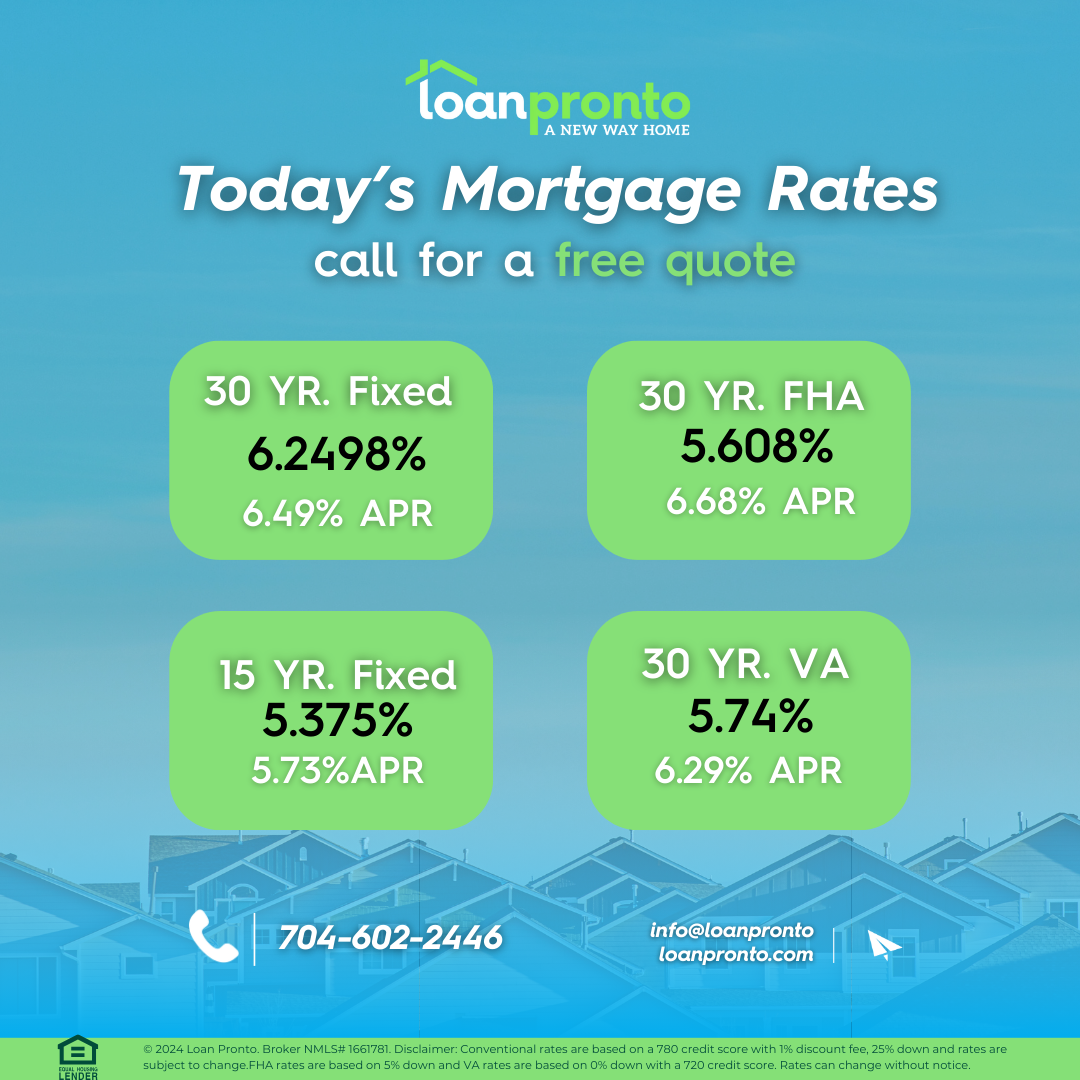

| Product | Rate | Last Week | Change |

| 30-year fixed | 6.2498% | 6.298% | ↓ 0.0482 |

| 15-year fixed | 5.375% | 5.375% | +/- 0.0 |

| 30-year FHA | 5.608% | 5.624% | ↓ 0.016 |

| 30-year VA | 5.74% | 5.74% | +/- 0.0 |

DISCLAIMER: ALL LOANS ARE SUBJECT TO CREDIT APPROVAL. INTEREST RATES ARE SUBJECT TO CHANGE DAILY AND WITHOUT NOTICE. CURRENT INTEREST RATES SHOWN ARE INDICATIVE OF MARKET CONDITIONS AND INDIVIDUAL QUALIFICATIONS AND WILL VARY UPON YOUR LOCK-IN PERIOD, LOAN TYPE, CREDIT SCORE, LOAN TO VALUE, PURPOSE, AND LENDING SOURCE. DISCLAIMER: FOR NEW JERSEY PURPOSES, WE ARE NOT A LENDER AND CANNOT GUARANTEE THESE INTEREST RATES.

Now at 6.2498%, down 4.82 basis points from last week. This option is popular for its lower monthly payments despite higher interest over the loan term.

15-year fixed-rate mortgages

Currently at 5.375%, down 0.0 basis points. While payments are higher, this loan helps borrowers pay off their mortgage faster and save on total interest.

Tools and Resources Use our free mortgage and amortization calculators to explore your monthly payments, including taxes, insurance, and interest. Take control of your financial future and maximize your savings.

No SSN required. Zero impact to credit. Your Information is never sold.