Good news for homebuyers and refinancers—mortgage rates dipped this week, hitting 2025 lows. The market dodged a potential rate spike thanks to a cooler-than-expected Consumer Price Index (CPI) report and weak retail sales data. Both reports signaled slower inflation and softer consumer spending, easing pressure on interest rates.

Why Did Mortgage Rates Drop?

Two key economic reports played a big role in pushing rates lower:

Lower CPI Inflation Data – Inflation came in lower than expected, reducing fears that the Federal Reserve will keep rates high for longer.

Weak Retail Sales – Consumer spending slowed, signaling a cooling economy, which often leads to lower interest rates.

These reports reassured investors that the Fed may be done with rate hikes, boosting confidence in lower mortgage rates.

What to Watch Next Week

The market will be watching for more economic data that could impact mortgage rates, including:

Jobless Claims – If unemployment rises, it could put more downward pressure on rates.

Fed Speeches – Any new signals from the Federal Reserve on rate policy could influence the market.

PCE Inflation Report – This is the Fed’s preferred measure of inflation, and a lower reading could push rates even lower.

What This Means for Homebuyers & Homeowners

With mortgage rates at 2025 lows, now could be a great time to lock in a rate before any market swings. If you’re thinking about buying or refinancing, staying informed and acting quickly can help you secure the best deal.

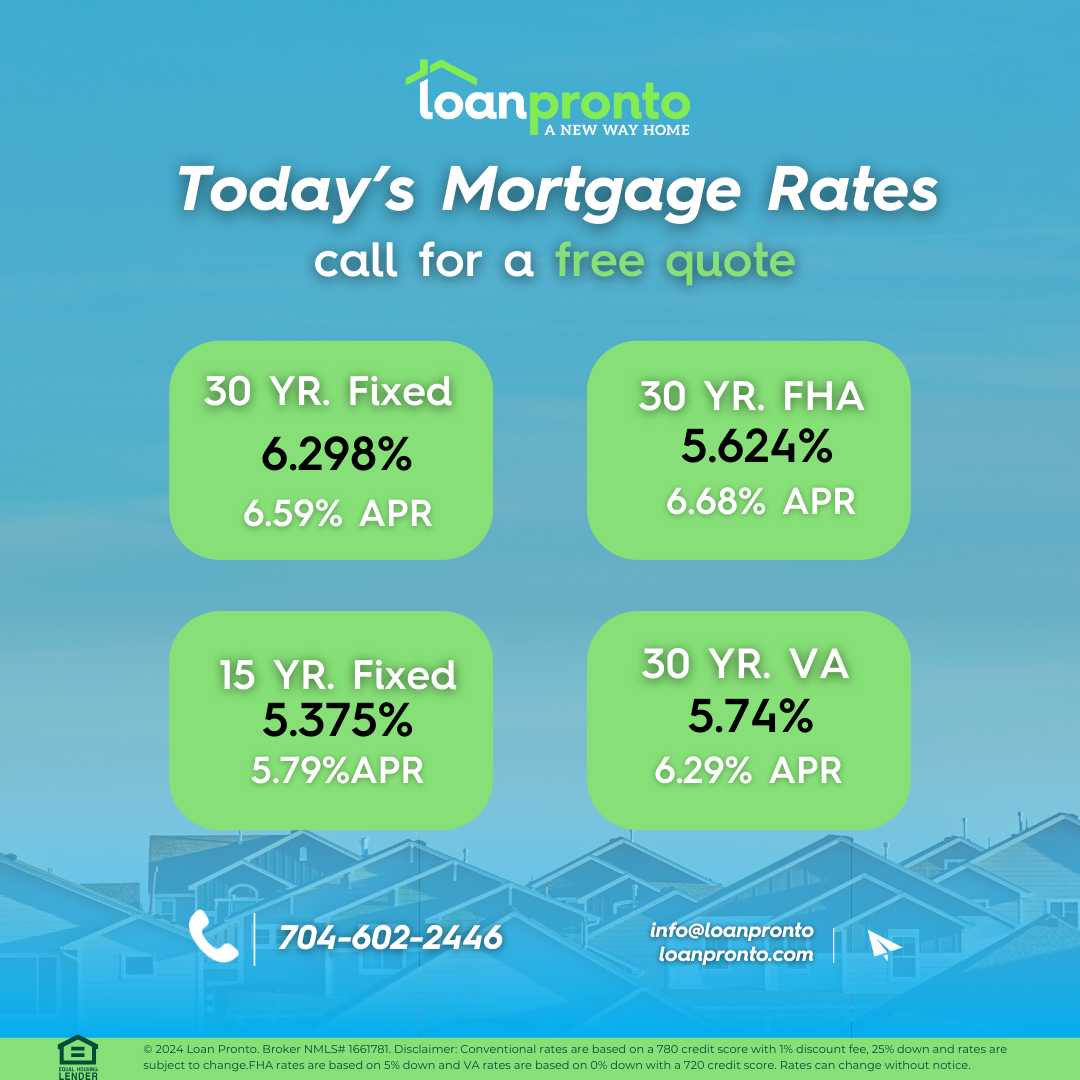

| Product | Rate | Last Week | Change |

| 30-year fixed | 6.298% | 6.375% | ↓ 0.077 |

| 15-year fixed | 5.375% | 5.49% | ↓ 0.115 |

| 30-year FHA | 5.624% | 5.99% | ↓ 0.366 |

| 30-year VA | 5.74% | 5.99% | ↓ 0.25 |

DISCLAIMER: ALL LOANS ARE SUBJECT TO CREDIT APPROVAL. INTEREST RATES ARE SUBJECT TO CHANGE DAILY AND WITHOUT NOTICE. CURRENT INTEREST RATES SHOWN ARE INDICATIVE OF MARKET CONDITIONS AND INDIVIDUAL QUALIFICATIONS AND WILL VARY UPON YOUR LOCK-IN PERIOD, LOAN TYPE, CREDIT SCORE, LOAN TO VALUE, PURPOSE, AND LENDING SOURCE. DISCLAIMER: FOR NEW JERSEY PURPOSES, WE ARE NOT A LENDER AND CANNOT GUARANTEE THESE INTEREST RATES.

Now at 6.298%, down 7.7 basis points from last week. This option is popular for its lower monthly payments despite higher interest over the loan term.

15-year fixed-rate mortgages

Currently at 5.375%, down 11.5 basis points. While payments are higher, this loan helps borrowers pay off their mortgage faster and save on total interest.

Tools and Resources Use our free mortgage and amortization calculators to explore your monthly payments, including taxes, insurance, and interest. Take control of your financial future and maximize your savings.

No SSN required. Zero impact to credit. Your Information is never sold.