As we step into 2025, the mortgage market is holding steady, offering a moment of calm for buyers, homeowners, and realtors alike. This week, mortgage rates remained unchanged from the previous week, providing a unique opportunity to evaluate options without the urgency of rapid market changes.

The stability in rates is a welcome relief after the fluctuations of 2024. For potential homebuyers, this is an excellent time to plan their next move, whether it’s locking in a competitive rate or assessing their home-buying budget. For current homeowners, consistent rates offer a prime opportunity to explore refinancing options, consolidating debt, or tapping into home equity at a predictable cost.

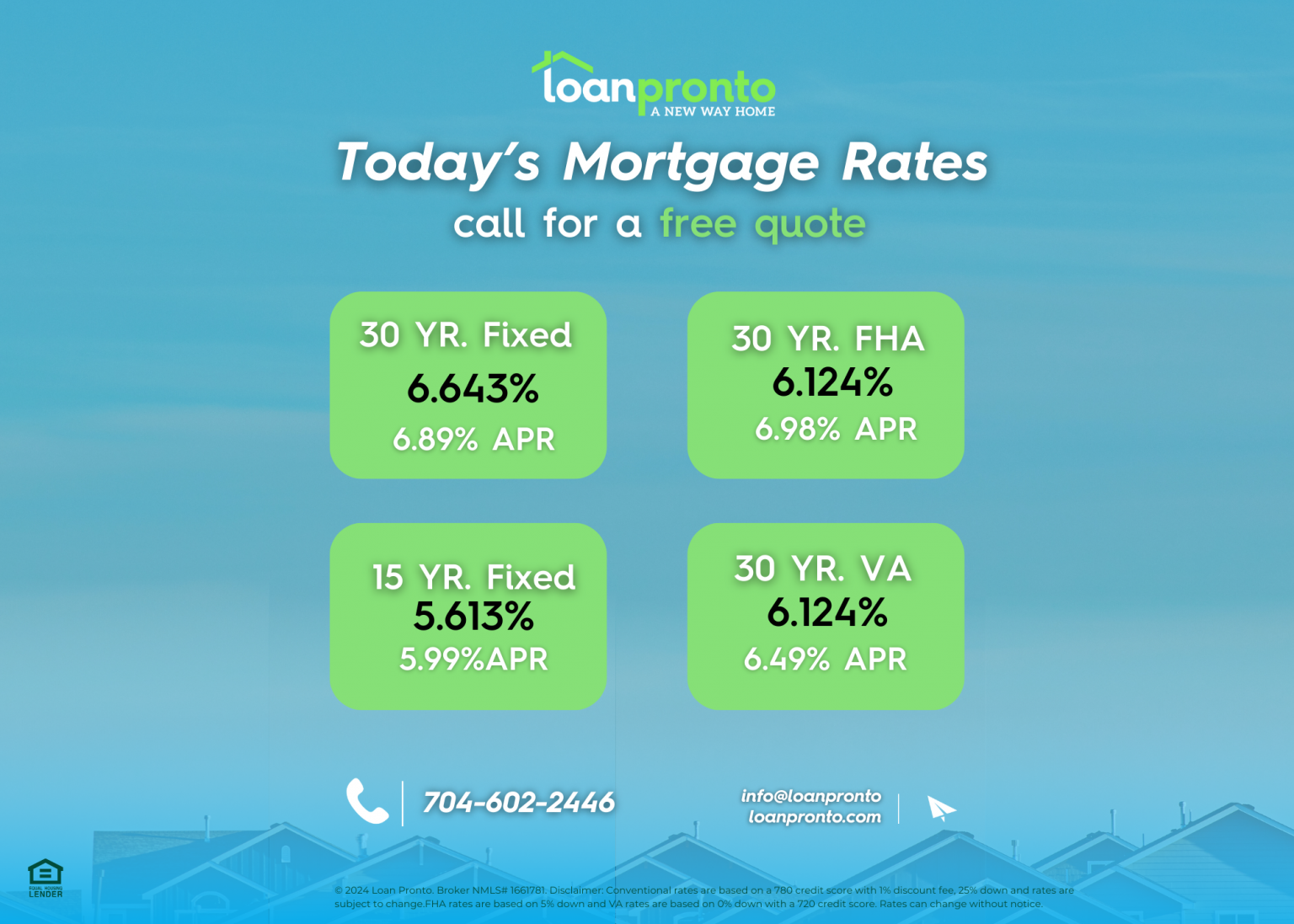

| Product | Rate | Last Week | Change |

| 30-year fixed | 6.375% | 6.375% | +/- 0.0 |

| 15-year fixed | 5.49% | 5.49% | +/- 0.0 |

| 30-year FHA | 5.874% | 5.874% | +/- 0.0 |

| 30-year VA | 5.874% | 5.874% | +/- 0.0 |

Why Stability Matters in the Mortgage Market

When mortgage rates remain steady, it creates an environment where financial decisions can be made with greater confidence. Buyers who were hesitant due to last year’s rate changes may feel encouraged to take the next step. Similarly, realtors can provide clients with more reliable guidance, strengthening trust and improving outcomes.

Looking Ahead: What to Expect in Early 2025

While this week’s consistency is a positive sign, the mortgage market is always influenced by broader economic conditions. In the coming weeks, key reports on inflation and employment are expected to shape market sentiment. These indicators could lead to rate changes and provide opportunities making it essential to stay informed.

What will influence mortgage rates in january?

- Inflation Data: Scheduled releases could signal whether inflationary pressures are easing or holding steady, influencing long-term rate trends.

- Employment Reports: A strong or weak labor market may sway rate forecasts and influence borrower confidence.

For now, the stability offers a rare moment for buyers, homeowners, and realtors to breathe, strategize, and position themselves for the months ahead.

Key Takeaways for Realtors

Encourage Action: This week’s unchanged rates could motivate hesitant buyers to step into the market before potential rate changes occur.

Prepare for Market Shifts: Stay informed about upcoming economic reports to help clients time their moves strategically. Capitalize on Early 2025

Momentum: Use the fresh start to the year to re-engage with clients, emphasizing the benefits of rate stability in their decision-making process.

How We Can Help

Navigating the mortgage market can be complex, but staying informed is the first step to making confident decisions. Whether you’re considering purchasing, refinancing, or just exploring your options, now is the time to act. Let this steady start to 2025 provide you with opportunities to take control of your financial future.

| Product | Rate | Last Week | Change |

| 30-year fixed | 6.375% | 6.375% | +/- 0.0 |

| 15-year fixed | 5.49% | 5.49% | +/- 0.0 |

| 30-year FHA | 5.874% | 5.874% | +/- 0.0 |

| 30-year VA | 5.874% | 5.874% | +/- 0.0 |

15-year fixed-rate mortgages

Use our free mortgage and amortization calculators to calculate your monthly payment, including insurance, taxes, and interest.

No SSN required. Zero impact to credit. Your Information is never sold.