Rates Dip After August Jobs Report

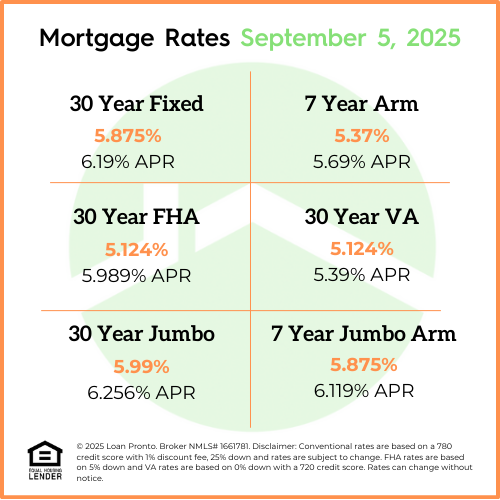

Mortgage rates moved lower this week after the release of the August jobs report. The report showed only 22,000 jobs added in August- bringing the 3 month average to 30,000. This report pushed rates to 12-month lows.

Why Rates Fell

When job growth slows, it signals that the economy may be cooling. That can reduce inflationary pressure, which often leads to lower mortgage rates. This week’s jobs data did just that, providing buyers with a bit of relief.

What to Watch Next Week

Looking ahead, markets will be paying close attention to upcoming inflation reports and any new commentary from the Federal Reserve. These updates will help shape expectations for whether rates continue to ease or level out in September.

What This Means for Real Estate

- For buyers: Lower rates improve affordability and can open more opportunities heading into fall.

- For sellers: Softer rates can attract more motivated buyers into the market.

- For agents: Now is a great time to remind clients that economic data directly impacts mortgage rates and this week’s dip could create momentum.

No SSN required. Zero impact to credit. Your Information is never sold.