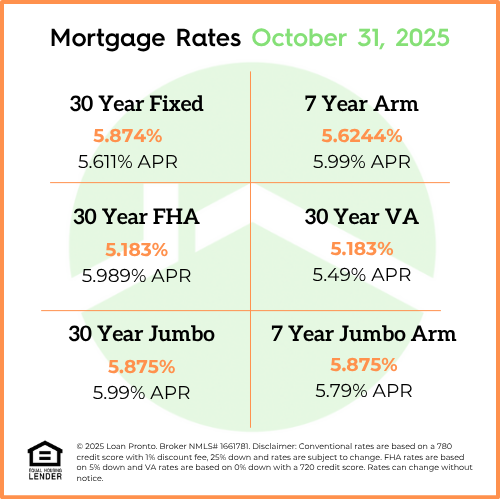

Mortgage Rate Update: Rates Tick Up After Fed Meeting

What Did Rates Do This Week

Mortgage rates increased slightly this week following the latest Federal Reserve meeting. The Fed’s comments on keeping rates higher for longer caused a small uptick in mortgage pricing as investors adjusted their expectations. Despite this move, rates remain near recent lows compared to earlier this year, and housing demand has stayed relatively steady as buyers adapt to current conditions.

What to Look Forward to Next Week

Next week should be quieter in terms of economic data, with no major inflation reports scheduled. Markets will be watching speeches from Federal Reserve officials and other economic indicators for clues about future rate policy. Any signs of slowing growth or easing inflation could help stabilize, or even improve, mortgage rates in the coming weeks.

Lock or Float Bias

With rates slightly higher after the Fed meeting, borrowers who are close to closing may want to lock in their rate to avoid potential volatility. However, if you have more time before your transaction finalizes, keeping an eye on market trends could pay off if rates ease again. As always, consult with your lender to align your rate strategy with your timeline and risk tolerance.

No SSN required. Zero impact to credit. Your Information is never sold.