Mortgage Rates Hold Steady After Fed Meeting – All Eyes on Next Week’s CPI Report

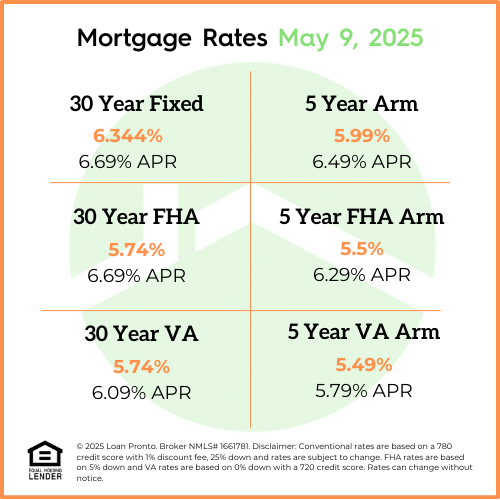

This week’s mortgage rate market stayed relatively calm following the much-anticipated Federal Reserve meeting. While the Fed chose to keep interest rates unchanged, comments from Fed officials reminded everyone that they’re still waiting for more consistent inflation progress before making any cuts. As a result, mortgage rates remained steady with a slight increase.

Meanwhile, across the pond, the UK’s central bank raised rates slightly — a move that markets didn’t love. That international pressure added a little upward momentum to global bond yields, which can indirectly influence U.S. mortgage rates.

If you’re a homebuyer or realtor watching the market, the big event to keep an eye on is next week’s Consumer Price Index (CPI) report. This inflation report could have a major impact on where rates go next. If inflation cools more than expected, mortgage rates may drop. But if it remains sticky, we could see rates tick up again.

No SSN required. Zero impact to credit. Your Information is never sold.