Mortgage Rate Update: Stability Continues Amid Quiet Market

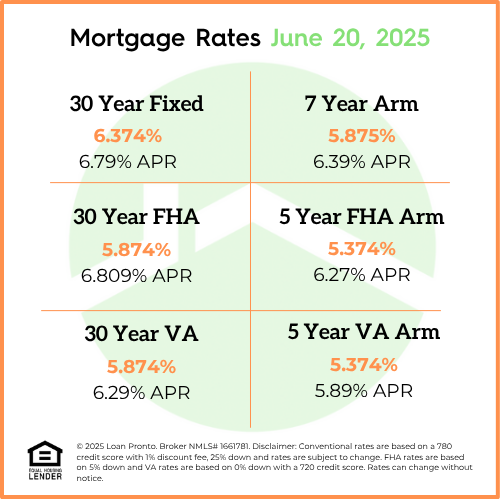

This week, mortgage rates remained very stable, offering buyers and homeowners a bit of consistency in an otherwise unpredictable market. After weeks of fluctuations driven by economic data and Fed speculation, this period of calm is a welcome breather—especially for homebuyers navigating today’s affordability challenges.

What’s behind the steady rates?

There were no major surprises in the market this week, and recent inflation data has largely aligned with expectations. That’s helped keep mortgage rates from moving much, giving lenders and borrowers alike a bit more confidence.

What does this mean for buyers and sellers?

For buyers, stable mortgage rates can improve affordability and make budgeting easier. For sellers, steady rates can encourage more buyers to act now rather than wait for rates to drop.

Looking ahead to next week

All eyes are on the Federal Reserve and upcoming economic reports. While no major changes are expected in the short term, any unexpected inflation news or shifts in Fed commentary could impact rate trends.

No SSN required. Zero impact to credit. Your Information is never sold.