Mortgage Rate Update: Rates Remain Near 3-Year Lows

What Did Rates Do This Week?

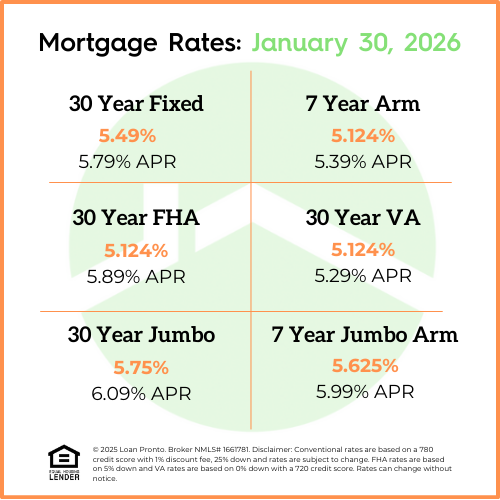

Mortgage rates moved slightly higher this week but mostly stayed flat compared to last week. Even with minor day-to-day changes, rates continue to hover near three-year lows, which is keeping buyer interest alive and helping affordability compared to recent months. For many buyers, the overall rate environment still feels favorable, especially when compared to where rates were last year.

What to Look Forward to Next Week

Next week’s mortgage rate outlook will likely be shaped by economic reports and inflation data, along with any signals from the Federal Reserve. With rates already sitting near multi-year lows, even small headlines can cause short-term movement. That means we could see continued stability, but brief volatility is still possible as markets react to new data.

Lock or Float Bias

With mortgage rates near three-year lows, the current lock-or-float bias leans toward locking, especially for buyers under contract or with tight timelines. Floating may still make sense for borrowers with flexibility, but expectations should remain conservative. Locking now helps protect today’s pricing while avoiding the risk of sudden market swings.

No SSN required. Zero impact to credit. Your Information is never sold.