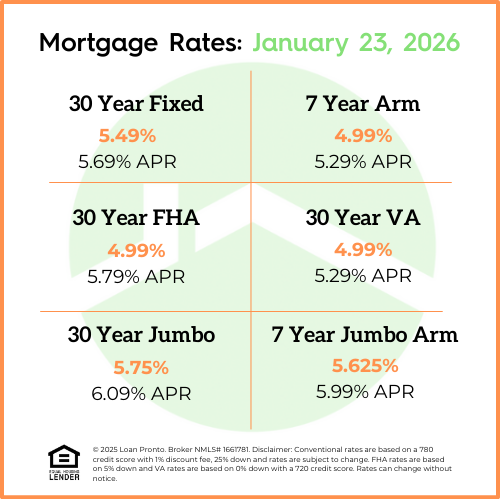

Mortgage Rate Update: Rates Hold Near 3-Year Lows

Mortgage rates were largely unchanged this week, continuing to hover near three-year lows. While movement was minimal, stability at these levels continues to support buyer confidence and keep affordability conversations active.

What Did Rates Do This Week?

Mortgage rates stayed mostly the same compared to last week, remaining near their lowest levels in about three years. The market saw very little volatility, which helped create consistency for buyers and sellers alike.

For real estate professionals, this type of steady rate environment can be helpful — it allows buyers to focus more on finding the right home rather than reacting to daily rate swings.

What to Look Forward to Next Week

Next week, investors and lenders will be paying close attention to upcoming economic data and market signals that can influence mortgage rates. While no major shifts are expected, even small changes in economic reports or inflation expectations can impact rate momentum.

With rates already near multi-year lows, markets may continue to move cautiously as they look for confirmation on where the economy is headed.

Lock or Float Bias

With mortgage rates holding steady near three-year lows, the current environment generally favors locking for buyers who are under contract or close to closing. Locking can help protect against unexpected market movement.

For buyers who are still shopping or have more time, floating may make sense — but it comes with some risk. As always, the best lock or float decision depends on timeline, risk tolerance, and overall market conditions.

No SSN required. Zero impact to credit. Your Information is never sold.