Weekly Mortgage Rate Update: A Quiet Start to the New Year

What Did Rates Do This Week?

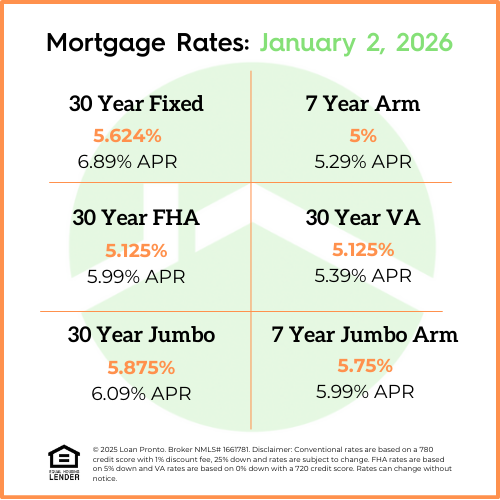

Mortgage rates largely stayed the same compared to last week, with a few minor increases across certain loan programs. With New Year’s Day earlier this week, overall market activity was slower, which often keeps mortgage rate movement limited. The result was a fairly calm week for rates, with no major shifts that would significantly impact buyer affordability.

What to Look Forward to Next Week

As the market returns to a normal schedule, lenders and investors will begin reacting more closely to upcoming economic data and market trends. With holiday disruptions behind us, mortgage rates may see slightly more movement, though expectations remain for gradual changes rather than sharp swings.

Lock or Float Bias

The current bias is neutral to slightly conservative. Since rates are mostly flat but showing small upward pressure, buyers who are close to closing may prefer to lock for stability, while those with longer timelines could consider floating—keeping a close eye on market conditions as activity picks back up.

No SSN required. Zero impact to credit. Your Information is never sold.