What Did Rates Do This Week?

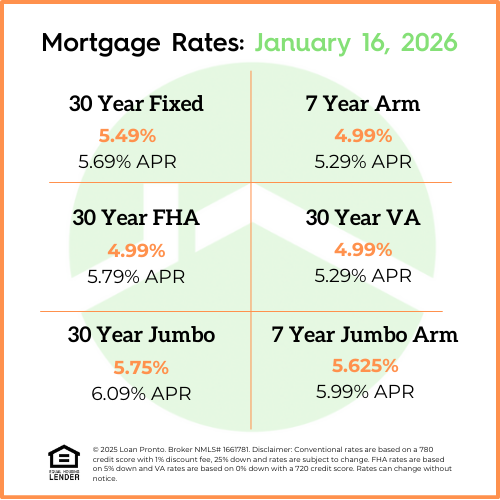

Mortgage rates were mostly unchanged from last week, holding steady near three-year lows. While there wasn’t a major move up or down, the bigger story is stability. After weeks of improvement, rates appear to be settling into a lower range, which is good news for buyers watching affordability and sellers trying to keep demand strong. Even flat weeks like this can be positive when rates are already sitting near recent lows.

What to Look Forward to Next Week

With a long holiday weekend ahead, market activity may slow down, and that often leads to quieter movement in mortgage rates. Fewer economic reports and lighter trading can help keep rates stable in the short term. Looking ahead, investors will continue focusing on inflation data and overall economic momentum, which will help determine whether rates can break lower or remain in this range.

Lock or Float Bias

With mortgage rates near three-year lows and a long weekend approaching, the current bias leans slightly toward locking, especially for buyers under contract or closing soon. Floating may still make sense for borrowers with more time, but when rates are already favorable, many choose to secure them rather than risk volatility returning after the holiday.

No SSN required. Zero impact to credit. Your Information is never sold.