What Did Mortgage Rates Do This Week?

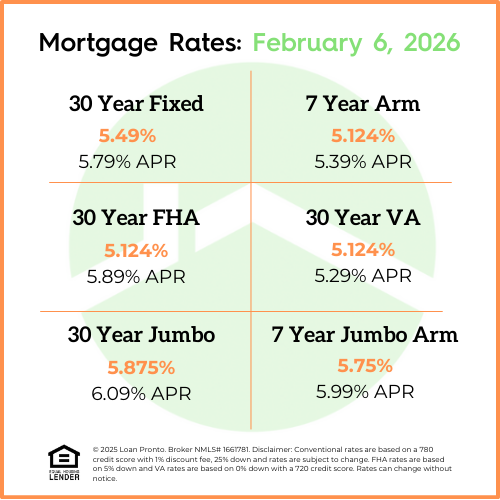

Mortgage rates mostly stayed the same as last week, holding near three-year lows despite small day-to-day movement. Bond markets were calm, and investors seemed comfortable with current economic conditions. A key factor was the latest ISM manufacturing data, which showed the economy continuing to cool without signaling a sharp slowdown. That balance helped keep mortgage rates steady.

For buyers and sellers, this stability is positive — predictable rates make it easier to plan, price homes, and keep deals moving forward.

What to Look Forward to Next Week

Next week’s focus will be on inflation data, labor market updates, and additional economic reports that help investors gauge whether inflation is truly easing.

Markets will also continue reacting to signals about potential future Federal Reserve rate cuts. Even though the Fed doesn’t directly set mortgage rates, expectations around Fed policy strongly influence where mortgage rates head next.

If upcoming data confirms slower economic growth without rising inflation, rates could remain favorable or improve slightly.

Lock or Float Bias

With mortgage rates still near multi-year lows, the current lock bias leans cautious.

Borrowers who are under contract or closing soon may benefit from locking in today’s levels and avoiding short-term volatility. For buyers with longer timelines, floating may make sense — but only if they’re comfortable with small swings tied to economic news.

Bottom line: this remains one of the more attractive rate environments buyers have seen in years, and stability continues to be the theme.

No SSN required. Zero impact to credit. Your Information is never sold.