Mortgage Rates Hit 38-Month Lows

What Did Rates Do This Week?

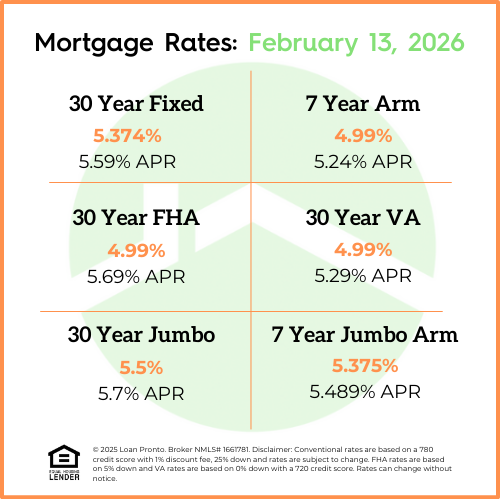

Mortgage rates decreased from last week, falling to their lowest levels in 38 months.

This marks a significant shift in the mortgage rate market, as rates continue trending near multi-year lows. Improved bond market performance and softer economic data helped push rates lower, increasing buyer affordability and boosting purchasing power.

For real estate agents, this creates a renewed opportunity:

- Lower monthly payments for buyers

- Increased buying power

- Stronger refinance conversations

- More urgency from rate-sensitive clients

When mortgage rates drop, buyer confidence often improves — especially for those who were waiting on the sidelines.

What to Look Forward to Next Week

Next week’s focus will be on upcoming economic data releases and Federal Reserve commentary, both of which can influence mortgage rate trends.

Key items to watch:

- Inflation reports

- Employment data

- Bond market movement

- Federal Reserve signals

If economic data continues to show slowing growth or easing inflation, mortgage rates could remain favorable. However, any surprise inflation or stronger-than-expected economic reports could cause short-term volatility.

The bond market will continue to drive day-to-day rate movement, so expect some normal fluctuation.

Lock or Float Bias

With mortgage rates at 38-month lows, many buyers are asking whether to lock or float their mortgage rate.

A general strategy in this environment:

- If closing soon, locking may protect against short-term volatility.

- If closing further out, floating could allow room for additional improvement — but with risk.

While the broader trend has improved, markets can shift quickly based on economic headlines. Protecting gains near multi-year lows is often a prudent approach for buyers with tight timelines.

No SSN required. Zero impact to credit. Your Information is never sold.