What Did Rates Do This Week?

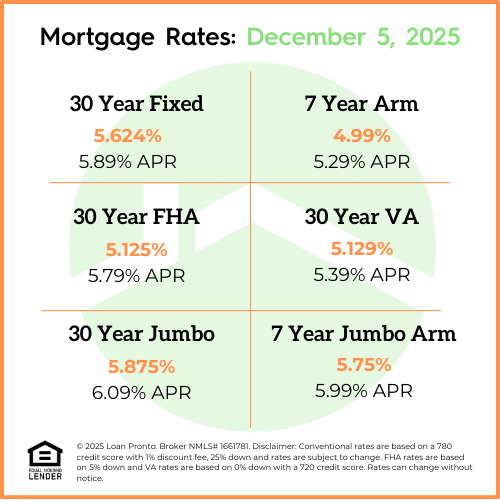

Mortgage rates decreased slightly, offering a bit more breathing room compared to recent weeks. The movement was subtle, but still in the right direction for homebuyers hoping for better affordability. Even though there wasn’t a large drop, this type of steady, mild downward trend helps keep buyer activity alive and can support more confidence in the market.

What to Look Forward to Next Week

The market will be watching upcoming economic reports and commentary for signs of momentum. Any new data on inflation, employment, or economic growth could influence how mortgage rates behave. If next week’s figures show cooling or stability in the economy, we could continue to see rate improvement. If the numbers come in hotter, rates may hold or shift sideways.

For realtors, the focus for next week is buyer readiness — those already pre-approved may benefit if the gentle downward pattern continues.

Lock or Float Bias

With rates trending slightly lower but without major movement, this week leans toward a neutral to slightly float-friendly stance. Buyers who are comfortable watching the market may consider floating short-term to see if soft improvement continues. However, those close to closing or risk-averse may prefer locking to protect their current position.

No SSN required. Zero impact to credit. Your Information is never sold.