What Did Rates Do This Week?

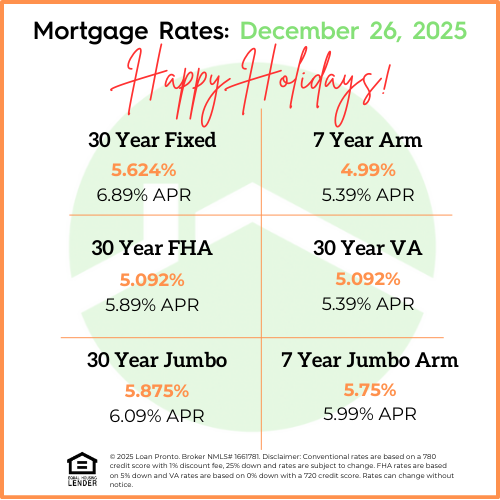

Mortgage rates remained mostly steady this week, with very little overall movement. Holiday-thin markets and a lighter economic calendar kept volatility in check, allowing rates to hold within their recent range. With fewer traders active and no major surprises in the data, the market stayed calm—providing borrowers with consistency rather than sharp shifts in affordability.

For buyers and sellers, this meant predictable conditions as the year winds down. While minor daily changes still occurred, there were no meaningful swings to disrupt active transactions or planning.

What to Look Forward to Next Week

As we head into the final days of the year and New Year’s week, the mortgage market is expected to remain quiet. Economic reports will be limited, and many market participants will still be operating at reduced capacity, which typically leads to muted rate activity. Unless unexpected economic news breaks, rates are likely to continue moving sideways rather than making decisive moves.

Looking ahead to early January, attention will begin to shift back toward upcoming inflation data and labor market reports, which could bring more clarity—and potentially more movement—once full market participation returns.

Lock or Float Bias

With rates holding steady and markets remaining thin, the bias continues to lean slightly toward locking for buyers who are under contract or nearing closing. The current environment offers stability, but limited upside, and thin holiday markets can still react quickly to surprise headlines.

No SSN required. Zero impact to credit. Your Information is never sold.