Mortgage Rates Drop: What’s Behind the Move & What Comes Next

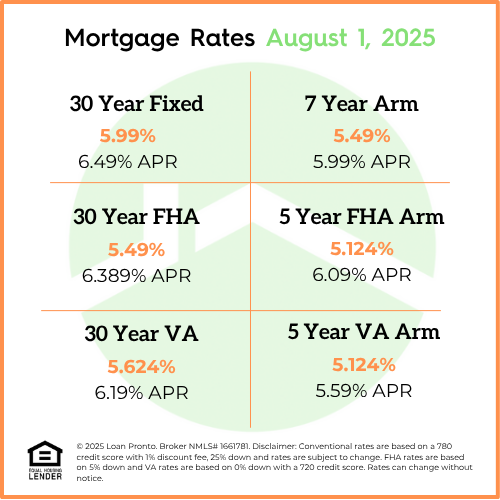

After weeks of relative stability, mortgage rates took a dip this week—offering a potential boost for buyers who’ve been waiting on the sidelines. So, what caused the sudden shift, and will it last? Let’s break it down.

Why Mortgage Rates Dropped This Week

Rates fell after a weaker jobs report showed the job market is slowing down. On top of that, job numbers from previous months were revised lower than initially reported.

This tells investors the economy might be cooling off, which means the Federal Reserve could lower interest rates sooner than expected. And when that happens, mortgage rates usually come down too—which is what we’re seeing now.

What’s Coming Next?

If inflation continues to cool, it could strengthen the case for lower mortgage rates in the upcoming weeks. But if inflation ticks up unexpectedly, we could see rates rise again.

This rate drop gives buyers a much-needed break. While we don’t know how long it’ll last, it’s a great time to reconnect with your loan officer and explore your options.

No SSN required. Zero impact to credit. Your Information is never sold.