Weekly Interest Rate Recap: Rates Drop as Markets React to Jobs Report and Tariff Concerns

This week, mortgage rates saw a welcome drop, giving buyers and homeowners a bit more breathing room. While the market bas been closely watching economic data, two big stories moved rates this week: the March jobs report and rising concerns over potential tariffs.

Stronger Job Growth, But Higher Unemployment

The latest job report showed that the U.S. added more jobs than expected—a sign of a strong labor market. However, the unemployment rate ticked up slightly, which sent mixed signals to investors. Typically, strong job growth would push rates higher, but the rise in unemployment gave the bond market some pause.

Tariff Fears Push Rates Down

Another key factor in this week’s rate movement was renewed fear of tariffs. Global markets don’t like uncertainty, and concerns about new trade tensions pushed investors toward safer assets like U.S. Treasury bonds. As bond prices went up, yields—and mortgage rates—came down.

What This Means for Buyers and Sellers

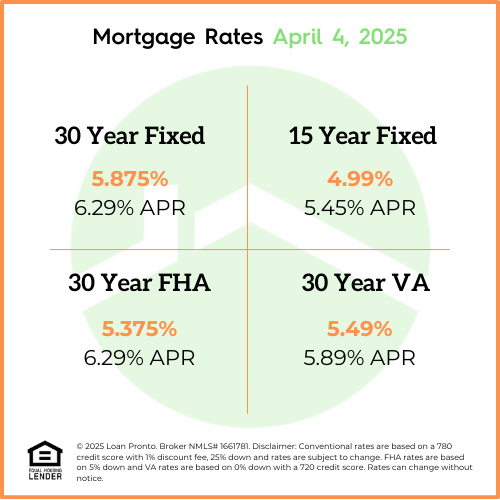

With mortgage rates dipping, this could be a great time for buyers to lock in a lower rate or for homeowners to explore refinancing options. For sellers, lower rates can help dive buyer demand by improving affordability.

No SSN required. Zero impact to credit. Your Information is never sold.