If you’ve been shopping for a home loan or looking to refinance, you’ve probably heard these two terms: interest rate and annual percentage rate (APR).

While both are expressed as percentages, these numbers are not the same. Homebuyers often seek the lowest mortgage interest rate but APR is just as important. What is the difference between interest rate and APR?

Interest rate

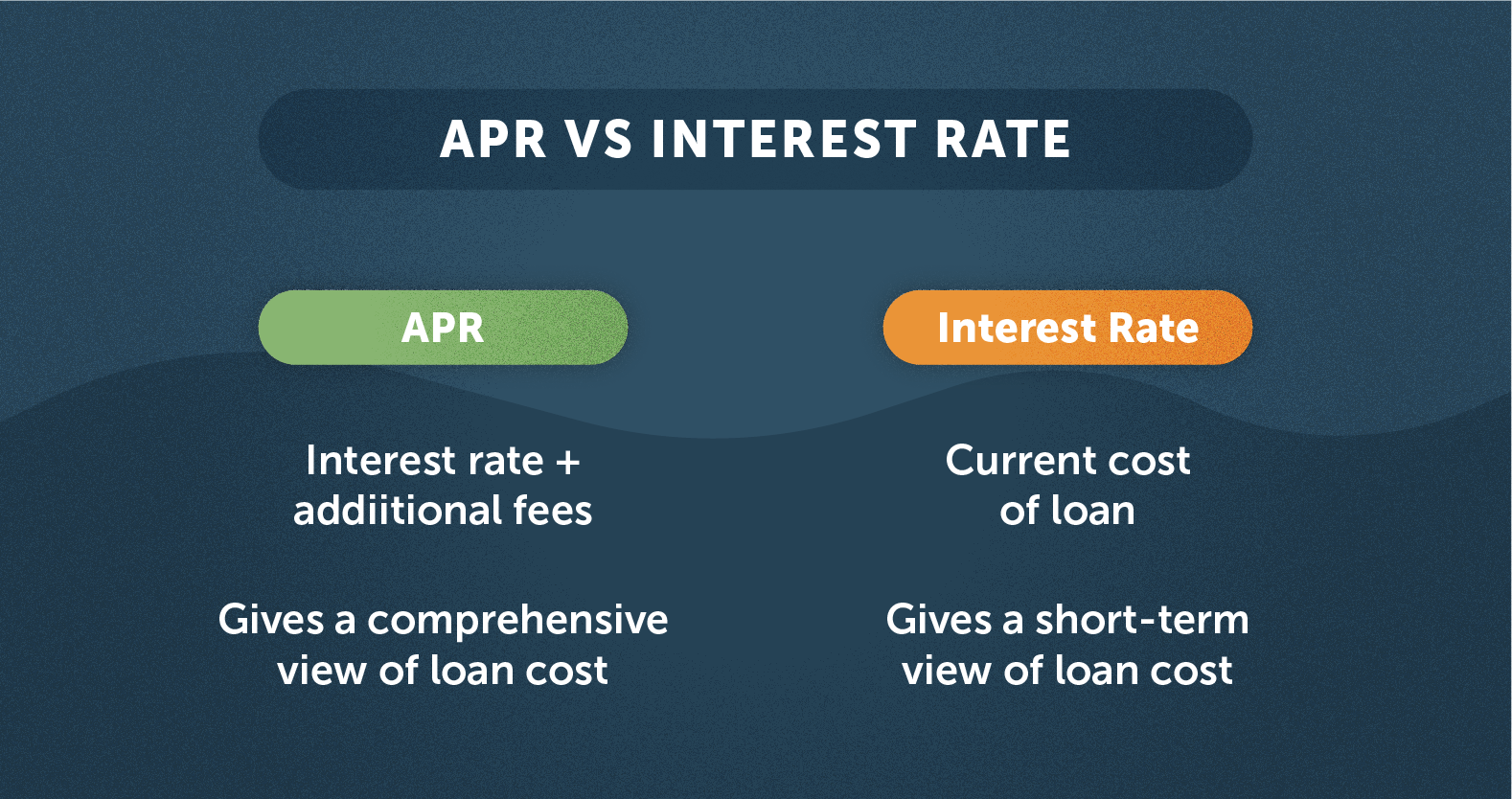

The interest rate is the percentage of principal that you’ll pay to a lender to borrow money. Interest rates are based on current market rates and economic trends as well as your loan amount, property location, and credit history. Mortgage interest rates may be fixed or adjustable, depending on which mortgage loan you choose.

The lower your interest rate the lower your overall mortgage cost and monthly payment. For example, if you take out a $180,000 fixed-rate mortgage with 3% interest, then you’ll pay $5,400 in total interest – or $450 per month.

Annual percentage rate (APR)

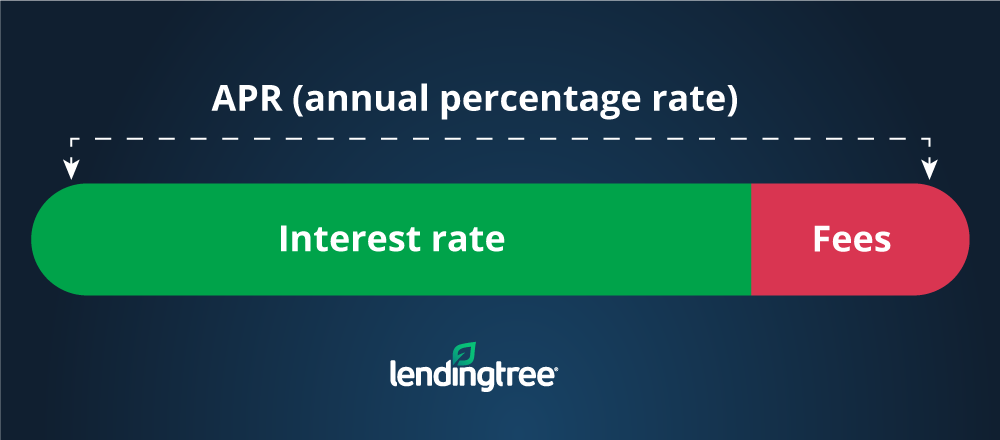

The annual percentage rate (APR) reflects both your interest rate and any additional costs associated with the mortgage. Additional costs may include origination fees, closing costs, private mortgage insurance (PMI), broker fees, discount points, prepaid interest, and more.

For this reason, APR typically reflects a higher number than your interest rate. In simpler terms, APR gives you a big-picture estimate of the cost of your loan as it considers the additional costs associated with mortgage loans.

APR is a more useful way to compare mortgages than interest rates as it shows the true cost of the loan. However, APR can get complicated as it varies from lender to lender. Lenders charge different fees and costs but at Loan Pronto, we don’t charge any lender fees.

The Truth in Lending Act of 1968 requires lenders to disclose APR to borrowers and ensures greater transparency in lending. So, remember to look at the interest rate and the APR when comparing mortgages as it is your right to do so.

The bottom line

While interest rate determines the cost of borrowing money, the APR more accurately represents the total cost of your mortgage. Homebuyers typically look at the interest rate first but looks can be deceiving. When shopping and comparing mortgages, it is critical to pay attention to APR.

Let’s look at an example.

Say Lender A offers an interest rate of 3%, while Lender B offers an interest rate of 3.75%. You’re probably thinking you should go with Lender A, right? Wrong! In order to understand the true cost of the mortgage over time, you need to know what both lenders are charging for additional fees such as closing costs, lender fees, broker costs, etc. – all of which factor into the APR. If Lender A and B charge the same fees except Lender B forgoes lender fees, like Loan Pronto, you’re ultimately better off with Lender B! You’ll get a better APR overall with Lender B.

Let’s get started

Use our free mortgage and amortization calculators to determine your monthly payments, including mortgage insurance, taxes, interest, and more.

To get started with the mortgage loan process, get a free rate quote or fill out our online loan application to get pre-approved!

Originally published March 4, 2019, updated August 3, 2021.

No SSN required. Zero impact to credit. Your Information is never sold.