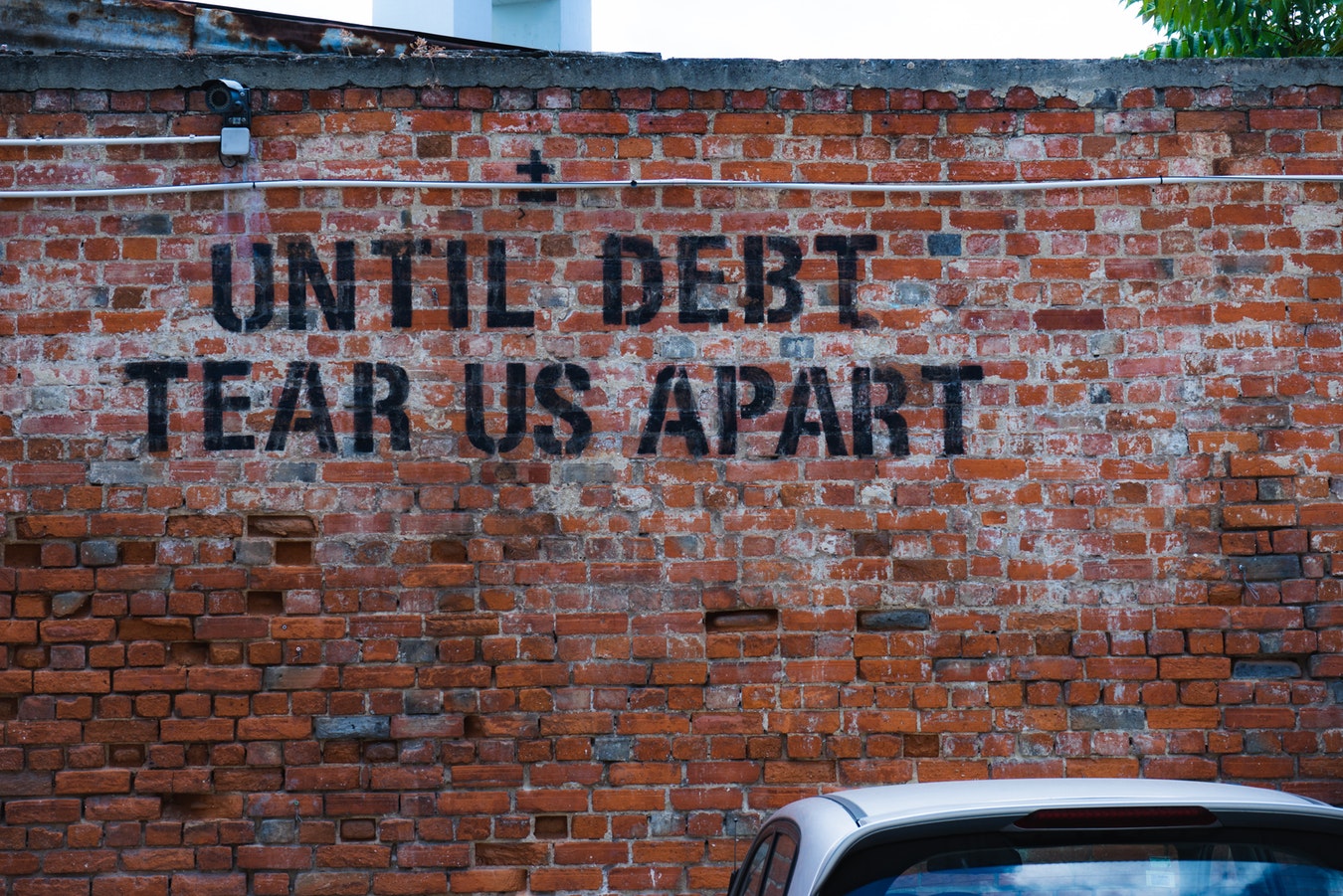

Are you reading this while also staring at the stack of bills on your kitchen counter that you are procrastinating until the last day to pay because you don’t want to face the reality of the interest you are racking up? Well, continue reading because you are in the right place. Now is the time to eliminate your debt. Yes, it’s possible. How? Simple. Tap into your home equity and consolidate your debt to create one monthly bill and one interest rate so you can start the new-year with a clean slate.

What is debt consolidation?

Now that I have your attention, let me break it down further. Debt consolidation means taking out a new mortgage loan that includes your current mortgage loan and your debts added together.

In simpler terms:

Your home value is $350,000, and your current loan balance is $220,000. You have $130,000 in home equity and can borrow up to 85% of your home’s value which means you can take out as much as $77,500.

You have $30,000 of debt, so you decide to consolidate your debt. Your new mortgage loan is $250,000 because you added your debts to your old mortgage. Your debts are paid off, and you now have only one payment and one interest rate to pay each month.

Debts that can be consolidated:

- Credit card debt

- Personal loans

- Student loans

- Medical bills

- Car payment

- 1st and 2nd mortgages

Benefits

There are several short-term and long-term benefits to consolidating your debt.

Stress. We all have it, especially if we are loaded down with bills. By paying off debt, you will be able to significantly reduce your stress. Lowering stress levels can help you concentrate on more important things rather than being bogged down by debt, which is one of the most common factors that creates it.

By consolidating debt, multiple monthly payments turn into one, single payment. Many people have several credit cards and loans that need to be paid each month, and by combining your debt, all payments go into one. In most cases, your new monthly payment will be cheaper than before because you have a longer period to pay it off. Now, instead of worrying about which account to pay off first, you can simply pay it all at once.

Along with single payments, you will also have one interest rate. Consolidating your debt into one payment can save you a great amount of money. Those who have several credit cards could be getting hit with extreme interest rates from those companies because they are usually higher compared to others in the market.

Your credit score could naturally improve. Having several late payments on past debts is a huge factor in hurting your score. Since you will have one monthly payment, it will be easier to manager and remember to pay on time.

Get My Custom Rate QuoteNo SSN required. Zero impact to credit. Your Information is never sold.