what will I pay over time?

Your amortization schedule shows how much money you pay in principal and interest over time. Use this calculator to see how those payments break down over your loan term.

what will I pay over time?

Your amortization schedule shows how much money you pay in principal and interest over time. Use this calculator to see how those payments break down over your loan term.

estimated monthly payment

1,890/mo.

lifetime loan breakdown

- Total Principal Paid

- Total Interest Paid

- Payoff Date

get a free, accurate personalized quote in 4 minutes.

No SSN required. Zero impact to credit. Your Information is never sold.

why work with loan pronto?

Learn more about our mortgage process, our loan options, and what to expect each step of the way.

Our Mortgage Process

Whether you’re loan shopping or trying to better understand your current loan payments, an amortization calculator can help.

Amortization tables are the best way to understand amortization and how your loan will be paid off over the loan term. Before we discuss the benefits of using an amortization calculator, let’s define amortization and amortization table.

Already understand amortization? Try our amortization calculator.

Related: Mortgage Calculator

What is amortization?

Amortization is the process of spreading out a loan into a series of scheduled payments. The scheduled payment is split between the loan’s principal and the interest accrued. With mortgage amortization, there is a gradual shift from paying mostly interest every month to paying mostly principal. Common amortized loans include fixed-rate mortgages, auto loans, student loans, home equity loans, and personal loans.

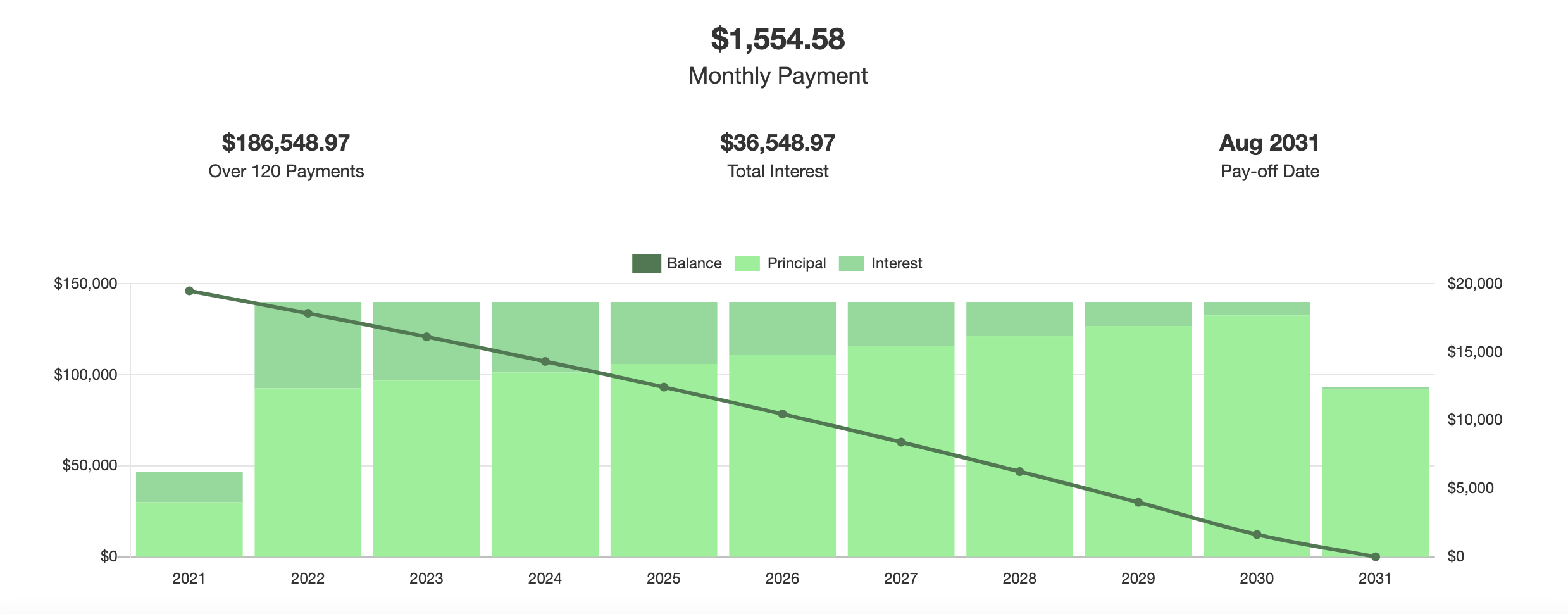

For example, let’s say you borrowed $150,000 to purchase a home. You got an amortized loan with a term of 10 years and an interest rate of 4.5%. Your monthly payment will be $1,554.58.

In the first month, $992.08 will be applied to the loan principal and $562.50 will be applied to interest. Every month, the process repeats itself and you’ll pay less and less towards interest.

In the last month, $1,548.14 will be applied to the loan principal and just $5.81 will be applied to interest. After 10 years (or 120 payments), you’ll have paid off your 10-year mortgage.

Amortization is often laid out on an amortization schedule or measured by an amortization calculator. Amortization tables allow you to visualize the lifetime of your loan in detail.

What is an amortization table?

An amortization table is a schedule that lists your monthly or yearly loan payment as well as the principal, interest, outstanding balance, and total paid. Although your monthly payment remains the same each period, you’ll be paying off the loan’s interest and principal in different amounts each month.

For example, our amortization calculator requires you to input your:

- Loan amount

- Term (years)

- Interest rate

- Start date

With these inputs, our amortization schedule will provide you with the following information:

- Yearly and monthly amortization schedule

- Principal per payment

- Interest per payment

- Total paid

- Outstanding balance

Our amortization calculator will provide you with a full yearly and monthly amortization schedule and a graph that allows you to visualize the balance, principal, and interest paid over the loan’s lifetime. An example is provided below using the loan terms from above ($150,000 10-year loan at 4.5%).

The benefits of using an amortization calculator

The main benefits of using an amortization calculator and schedule include:

- Fixed loan payments

Once you’ve chosen a fixed-rate loan, you receive fixed loan payments. Accepting a fixed-rate loan provides you with consistency and simplicity. It allows you to plan and maintain your monthly finances without having to worry about increasing or varying interest rates.

- The power of comparison

If you haven’t chosen a loan type yet, amortization schedules allow you to compare how much you’ll pay on each type of loan and the overall accrued interest. This can help you understand how different loan types, terms, and interest rates affect your monthly payment, providing you with the best option.

Related: Interest rate vs. APR

- Time savings

Amortization calculators require few inputs before providing an extensive, easy-to-understand amortization schedule that will help save you time throughout the loan’s lifetime.

- Knowledge

An amortization schedule will arm you with insight and awareness. You will better understand how loans work and what each monthly payment is going towards.

Long story short, amortization schedules make your life easier. Who doesn’t want that?

Let’s get started

Use our free mortgage and amortization calculators to determine your monthly payment, including mortgage insurance, taxes, interest, and more.

To get started with the mortgage loan process, get a free rate quote or fill out our online loan application to get pre-approved!

what will I pay over time?

Your amortization schedule shows how much money you pay in principal and interest over time. Use this calculator to see how those payments break down over your loan term.

what will I pay over time?

Your amortization schedule shows how much money you pay in principal and interest over time. Use this calculator to see how those payments break down over your loan term.

estimated monthly payment

1,890/mo.

lifetime loan breakdown

- Total Principal Paid

- Total Interest Paid

- Payoff Date