Mortgage insurance is fairly common for those taking out a loan on their home. A good rule of thumb is that if you’re putting down less than 20% of the purchase price, you will likely be required to pay for mortgage insurance. If you have an FHA or USDA loan, however, it is required regardless of how much you put down.

Mortgage insurance helps lenders mitigate risk when loaning you money. The insurance guarantees that the loan will be paid off, and it can be removed on certain loan types once enough equity has been put into the home.

Let’s break down what you can expect to pay for mortgage insurance with conventional, FHA, USDA, and VA loans.

Conventional loans

Because conventional loans aren’t government-backed, lenders will rely on private mortgage insurance (PMI). The PMI payments on a conventional loan are typically cheaper than those with an FHA loan, and are typically paid monthly.

Generally, you can expect PMI to cost anywhere from .5% to 2% of the loan amount, depending on the loan size and your credit score. PMI can be removed from a conventional loan, either by requesting the cancellation once you reach 20% equity in your home or when it is (usually) automatically canceled once you reach 22% equity.

Example: You buy a $300,000 home and put 5% down. The PMI will differ by person, but let’s say you have a PMI rate of 1%. You can expect to pay around $22,000 in PMI up until you reach 20% equity in the home, which would add about $235 to your monthly mortgage payments.

FHA loans

Mortgage insurance is required for FHA loans, and payments go directly to the Federal Housing Administration (FHA). Typically, this type of mortgage insurance cannot be canceled and must remain in place for the life of the loan.

The costs associated with mortgage insurance on an FHA loan are split into an upfront premium and an annual mortgage insurance premium (MIP). The upfront premium will almost always be 1.75% of the loan amount and is paid at closing.

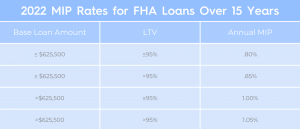

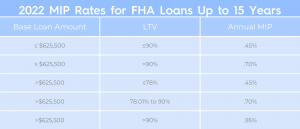

The annual MIP is divided by 12 and paid monthly, and it can range from .45% to 1.05% of the loan amount, depending on loan size, loan term, and down payment percentage. The chart below breaks down 2022’s annual MIP rates.

USDA Loans

The USDA mortgage insurance program works very similarly to the FHA, but is usually cheaper and gets paid to the US Department of Agriculture (USDA). There is an upfront cost and monthly payments.

The upfront guarantee fee, whether refinancing or purchasing, is 1% of the loan amount and can be divided throughout your monthly mortgage payments. There is also a .35% annual fee divided into monthly payments based on the remaining principal loan balance each year.

VA Loans

With a loan backed by the Department of Veterans Affairs (VA), instead of mortgage insurance, you have a VA guarantee. There is no monthly cost added to your mortgage payment on a VA loan, but instead, it is all paid upfront as a funding fee. The typical fee is about 2.3% of the loan amount but can be anywhere from .5% to 3.6%.

Some factors that can affect the funding fee are:

- the down payment amount

- whether you’re buying or refinancing

- your disability status

- type of military service

- whether this is your first VA loan or not

The bottom line

Most homeowners will need mortgage insurance at some point, so it’s good to know what kind of additional payments you can expect with it. Fees are likely to vary from person to person depending on a number of factors, so remember to take these into consideration when adding or altering your mortgage.

Let’s get started

Use our free mortgage and amortization calculators to determine your monthly payment, including mortgage insurance, taxes, interest, and more.To get started with the mortgage loan process, get a free rate quote or fill out our online loan application to get pre-approved.

No SSN required. Zero impact to credit. Your Information is never sold.