Are you in the market to purchase a new home or refinance your current mortgage? If yes, DTI is a term you need to be familiar with. DTI stands for debt to income ratio, and it helps your lender determine what mortgage payment you can afford.

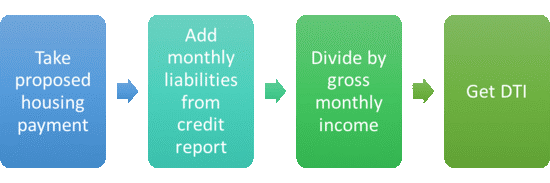

Calculating DTI is pretty simple. The lender does this by looking at the proposed mortgage payment and then adding all of your monthly liabilities to that. They get these numbers such as car payment, student loans, and credit cards from your credit report. Then, they divide that number by your monthly gross income and you get your DTI in the form of a percentage.

Each lender or loan program will have a maximum DTI that they allow borrowers to have. This percentage usually ranges from 40- 50% for Conventional Loans. For FHA Loans DTI can be up to 55% and VA Loans allow up to 60%. Lenders use this percentage as a way to gauge the borrower’s ability to handle debt. This gives the lender security and prevents un-qualified borrowers from getting into mortgages they can’t afford.

Here’s a quick example:

Monthly gross income – $10,000

Monthly liabilities – $4,500

DTI = 45%

A good rule of thumb for DTI is, the lower the better. Although it is also important to remember that DTI accounts for monthly costs such as credit cards and student loans, it doesn’t factor in other monthly payments that most borrowers take on as well. Costs such as cable bills, cell phone bills, and health insurance premiums are not included in the DTI. Its smart to keep these expenses in mind because usually lenders factor in two percentages. Front-End and Back-End DTI Ratios.

Front-End DTI = Proposed Monthly Housing Expense

Income

Back-End DTI = Monthly Liabilities + Proposed Monthly Housing Expense

Gross Monthly Income

If you find that your DTI comes in high, you can lower it by putting more money down on your home or buying down your interest rate. Both of these options will help to reduce the monthly mortgage payment.

Your Mortgage

To calculate your monthly payment, click here for our simple mortgage calculators.

To get started with the mortgage loan process, get a free rate quote, or fill out our online loan application to get pre-approved!

No SSN required. Zero impact to credit. Your Information is never sold.