What Did Rates Do This Week

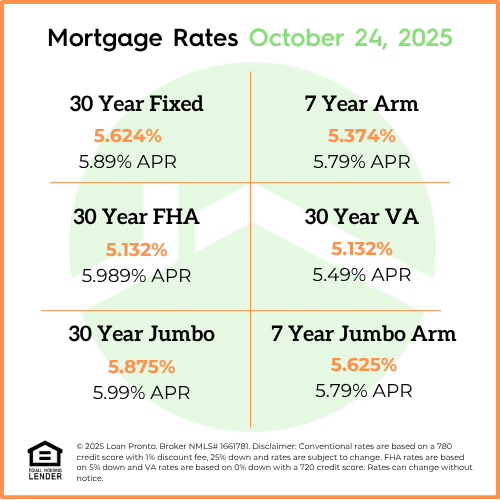

Mortgage rates saw small movements this week, with some slight decreases across FHA and VA loans. Overall, rates continue to hover near their lowest levels in nearly two years. For homebuyers and homeowners, this means affordability remains strong, keeping purchase and refinance opportunities attractive heading into fall.

Even with a few day-to-day fluctuations, market sentiment remains optimistic as inflation data and economic uncertainty continue to support lower long-term yields, which help keep mortgage rates steady.

What to Look Forward to Next Week

Looking ahead, markets will be watching upcoming inflation reports and any new updates from the Federal Reserve for clues about future rate direction. If data continues to show cooling inflation and slower economic growth, rates could stay around current levels or even trend slightly lower.

However, any stronger-than-expected economic data or signals of renewed inflation pressure could cause rates to tick up again. For now, most analysts expect continued stability rather than any sharp movement.

Lock or Float Bias

With rates still near two-year lows, locking in can be a smart move for borrowers who are ready to move forward. It protects against any unexpected market swings or sudden increases.

That said, if your closing is still several weeks away, there may be some room to float and watch for small rate improvements, but it’s important to stay in close contact with your lender for real-time guidance.

No SSN required. Zero impact to credit. Your Information is never sold.