What Did Rates Do This Week

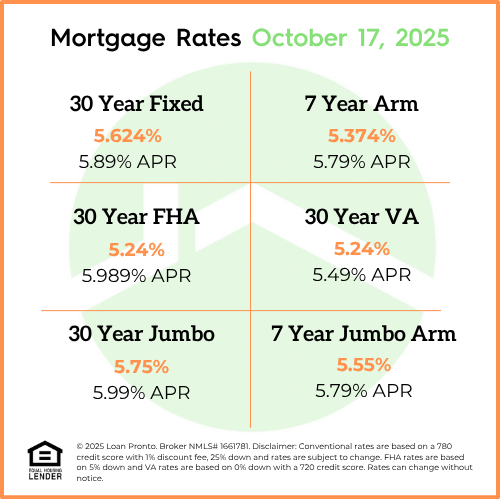

Mortgage rates moved lower again this week, reaching their lowest levels in nearly two years. After months of gradual improvement, recent economic data and continued uncertainty around the government shutdown have helped ease pressure on the bond market, allowing rates to trend downward.

For homebuyers, this dip provides a welcome boost in affordability and increased purchasing power. For current homeowners, it may be a good time to explore refinancing opportunities before conditions shift again.

What to Look Forward to Next Week

Next week’s market will likely stay focused on economic data releases, especially if government operations resume. Any updates tied to inflation, employment, or consumer spending could influence where mortgage rates move next.

If the shutdown continues, the delay of key reports may lead to some short-term volatility, as investors and the Fed will have less information to guide decisions. Overall, rates could continue to hover near current lows unless stronger-than-expected economic news causes a rebound.

Lock or Float Bias

With rates sitting near two-year lows, this is generally a favorable time for buyers and homeowners to lock in their rate. While there’s always a chance of further improvement, the risk of rates ticking higher is growing as markets anticipate future policy updates and data releases.

For clients who are under contract or close to closing, locking now can help secure today’s favorable conditions. Those still shopping for a home may want to stay in close contact with their lender to monitor daily rate movements.

No SSN required. Zero impact to credit. Your Information is never sold.