Slight Uptick as Markets Await Jobs Data

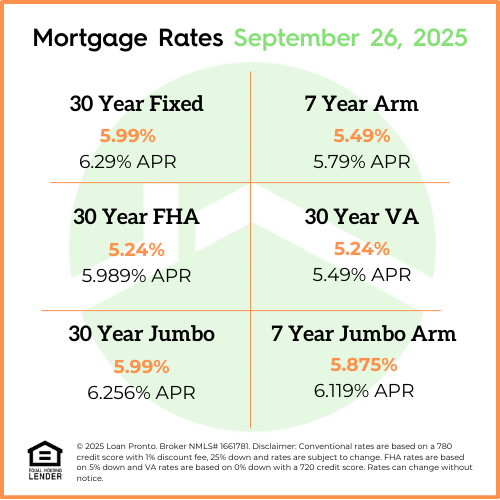

Mortgage rates inched slightly higher this week, marking a modest move after several weeks of relative stability. While the change isn’t dramatic, even small rate movements can influence affordability and monthly payments for homebuyers and homeowners considering a refinance.

What’s Driving the Market

The recent uptick was mostly driven by normal market fluctuations rather than any major economic news. Rates remain near their lowest levels in months, continuing to support strong purchase power for buyers and potential savings opportunities for those exploring a refinance. However, that could change soon as new economic data is released.

All Eyes on the September Jobs Report

The next major event on the horizon is the September jobs report, which often has a significant impact on mortgage rate trends.

- Stronger job growth could signal a resilient economy, which may put upward pressure on rates.

-

Weaker employment data could ease market concerns and potentially bring rates down slightly.

Because of this, the coming week may offer clues about where mortgage rates are headed as we move into the final quarter of the year.

Lock or Float? What It Means for Borrowers

With rates still hovering near recent lows, many borrowers may choose to lock in now to secure payment certainty. Others, particularly those with more flexibility in their timeline, might wait to see how the jobs report affects the market.

Either way, staying informed about economic data and understanding how it shapes mortgage rates can help buyers and homeowners make more confident decisions in the weeks ahead.

No SSN required. Zero impact to credit. Your Information is never sold.