Weekly Interest Rate Recap: Mortgage Rates Cool Off After Tariff Jitters

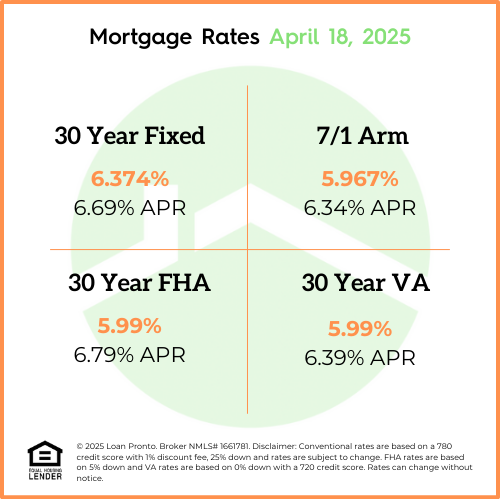

After a sharp rise last week, mortgage rates settled down a bit this week as the market digested recent tariff news. While last week’s headlines about potential new tariffs sparked concerns over inflation and pushed rates higher, those fears began to ease—bringing some relief to mortgage rates.

The bond market, which heavily influences mortgage rates, calmed down as investors realized the tariff impact might not be as immediate or severe as expected. As a result, average mortgage rates dipped slightly, offering a small window of opportunity for buyers and homeowners considering a refinance.

What to Watch for Next Week

Looking ahead, all eyes will be on upcoming economic reports, especially inflation data and any comments from the Federal Reserve. If inflation continues to show signs of cooling, we could see mortgage rates hold steady—or even drop a bit further. However, any surprises could send rates back up.

Mortgage rates are still relatively high compared to the last few years, but small week-to-week changes can make a real difference in affordability. If your clients are on the fence, now is a good time to re-run their numbers and check in on current rate options.

No SSN required. Zero impact to credit. Your Information is never sold.